Monday, July 31, 2006

How sexy is Freakonomics?

On a related note, I received my free autographed Freakonomics book plate from Steven Levitt and Stephen Dubner a while back, as I'm sure thousands of others did. Naturally, being a skeptic, I can't help but wonder what the story is behind this give-away. An experiment by the authors perhaps?

If so, I guess we'll find out when the market is fully infiltrated with autographed copies. Apparently some people have a lesser estimate of the popularity of the give-away than I do – a quick check at eBay tells me someone is looking to sell a signed copy outright for $90USD.

Giving immigrants `the business'

Here's an excerpt:

The number of business-class immigrants coming to Canada has dropped by a whopping 50 per cent since 1993, prompting fears of the demise of what was once a bread-and-butter immigration class that pumped billions of dollars into the country's economy.

At the peak of the influx in 1993, a total of 7,217 entrepreneurs and investors — led by people from Hong Kong, Taiwan, South Korea, China, Egypt and Saudi Arabia — landed in Canada, compared with last year's 3,341.

The drop comes as little surprise to immigration lawyers, who say the average time it takes to process applications by immigrants looking to park their assets in Canada has grown to five years. A decade ago, it took as little as eight months. It's now easier to get a sponsorship for Grandma through the red tape — just 37 months on average.

"This particular group of immigrants likes to do business in a business way. They are not going to put their money and business plans on hold for five years to wait for a decision," explains Bay Street immigration lawyer Mendel Green, who has seen his

business-immigrant files shrink 90 per cent over the past decade.

Several of his clients — with a net worth of $55 million — have been waiting to see their files processed for almost four years, a few of them since 2001. Some, tired of

the delay, have abandoned their applications altogether.

"The economies of China, India and Russia are booming and, all of a sudden, we are seeing a new crop of instant millionaires," Green says. "Things are changing around the world so quickly and Canada can't afford to be smug any more."

It's not all bad news. The number of applicants in the wealthier investor category has actually risen significantly, from 1,607 to 2,590, over the past decade. But the

entrepreneurial class — people who come here to set up small businesses and thus

create jobs directly — has taken a huge dive, from 3,208 to a meagre 751 in 2005.

The impact of long processing times is obvious: Business-class applications have declined steadily from 5,378 in 2001 to fewer than 3,000 in 2005. In the first five months of this year, fewer than 900 applications were filed.

The drop means a significant loss of investment. Between 1986 and 1999, immigrant investors brought $2.7 billion into Canada as part of their obligations under the program. Even in the declining years, between 2000 and 2004, immigrant investors dropped $720 million into provincial economies.

Saturday, July 29, 2006

Equalization: Is a non-renewable resource an asset?

By far the best point I've seen raised on this issue is regarding the formula used to calculate equalization. How should we calculate profits from non-renewable resources? Here are some excerpts from the Atlantic Institute for Market Studies (AIMS) website:

The equalization program is a major bone of contention at the Council of the Federation meetings, which wrap up in St. John's, N.L., today. The 13 provincial and territorial premiers agree the program, which is designed to allow provinces to provide similar services across the country through payments from the federal government, needs to change to fix the so-called "fiscal imbalance" between Ottawa and the provinces. They just can't seem to agree how.

Resource revenue is included in the current formula and some provinces, such as New Brunswick, Quebec, Manitoba and P.E.I., want it to stay that way, arguing that a dollar is a dollar, no matter where it comes from.

But the AIMS report argues that a non-renewable resource is an asset, not a revenue from income or sales taxes or from renewable resources such as forestry or hydroelectric power."Non-renewable natural resource revenues come from the sale of finite resources," argues the report. "When the oil and gas, or copper, or coal, or nickel are gone, they are gone. So, when we sell these resources, it is a one-time deal. God is not going to put new oil and gas and coal and copper under the ground when we deplete current resources.""We therefore have both a financial responsibility and a moral obligation not to treat this money like a lottery windfall, or to sell the house to finance a splurge on fancy cars and new clothes."

Any changes to the equalization program should consider what provinces are doing with the money they receive from non-renewable resources, argues the report. If they spend the money on ordinary programs, it should be taken away from their equalization entitlement, but if they invest it or apply it to provincial debt, it should not count against them.

Minimum wage and social costs

In the end, there is no good substitute for an appeal to facts. What the facts show is that the minimum wage is poorly targeted as an anti-poverty program. Moreover, while the evidence is controversial, some studies find significant long-term adverse effects. As a result, most economists prefer more efficient and better targeted anti-poverty tools, such as the EITC, which has grown significantly over the past few decades.

If minimum wage fails to keep up with inflation, all else being equal, it's likely that the social cost will lead to a negative net fiscal effect. So, which is more effective to reduce poverty: a social net, or a high primary income distribution? I thought I would explore the effects of minimum wage on net fiscal effects, since I know little on this. Further, it seems that this should be an especially hot topic in Canada given the recent ruling against Wal-Mart in the Saskatchewan labour dispute and the similar labour cases pending against the store elsewhere in Canada.

The following explanation by Jared Bernstein and L. Josh Bivens makes the most sense to me. Their paper was written for the Economic Policy Institute (EPI), a US-based “nonpartisan think tank.” It is specific to wages at Wal-Mart:

Part of this debate comes down to whether policy makers should be more concerned about primary or secondary income distributions. In other words, is it better to intervene directly and require employers to pay a living wage or to allow whatever compensation employers choose to pay but supplement it with government supports? The primary income distribution is that which holds before the effects of taxes and government transfer payments (i.e., Social Security payments, unemployment compensation, disability income, etc.) are factored in.

The secondary distribution includes the effect of all taxes and transfers. When it comes to offsetting the damage to the wage structure we document above, many policy analysts seem to believe that the sole intervention point is the secondary distribution. That is, they are quick to accept the primary distribution as an outcome that cannot and/or should not be altered. In their view, if the market is generating "too much" inequality, the government can offset this through redistributive fiscal policy. Many defenders of Wal-Mart's current business model advocate expanding the Earned Income Tax Credit (EITC) as the "correct" way to help Wal-Mart's workers.

While there is some merit in this view, this strategy makes U.S. workers and their households too reliant on the single instrument of fiscal redistribution—the expansion of transfer programs. EITC expansion, for example, is clearly a viable policy remedy for lost earnings, but there are reasons not to rely solely on this

strategy.

First, it relies on tax increases. We cannot ask American workers to depend exclusively on taxpayers and politicians continually ratcheting up their willingness to offset the degradation of the wage structure induced by Wal-Mart, not to mention globalization, the loss of manufacturing employment, union power, and so on.

Second, the federal budget is already constrained by the current and, more importantly, the projected gap between future federal outlays and revenues under current policies. According to the Congressional Budget Office, under plausible assumptions, that gap is expected to grow much wider in coming decades, largely due to the pressure of health care price increases and current tax policies.3 This does not mean that potentially useful policies like expanding the EITC should be off the table, but it does mean that any spending program outside of defense and homeland security faces a very steep challenge for at least the medium term. Wal-Mart defenders who argue that workers harmed by its practices should rely on government transfers to make ends meet are essentially telling those workers to get taxes raised if they want any help, and to struggle in the meantime.

Recent budget developments indicate that no help is on its way. While Wal-Mart supporters argue that it's fine for Medicaid to pick up the health coverage of uninsured workers, the president has proposed $5 billion in cuts to Medicaid over the next five years and has proposed an additional $5 billion in cuts to other programs for low-income people in his most recent budget. Further, in February of this year, Congress passed a budget reconciliation that included a $27 billion cut in Medicaid over 10 years. In other words, the tide is pushing hard against expanding these redistributive measures, and may be for some time to come.

Another point I found interesting in the article is this:

Essentially, the defenders of Wal-Mart argue that the price-depressing effects of Wal-Mart outrun the wage-depressing effect, leading to rising purchasing power for American workers. However, the prices that are reduced through Wal-Mart's expansion constitute an ever-shrinking share of American families' expenditures.

The paper provides further explanation.

Information on earned income tax from a Canadian perspective can be found here. If anyone can suggest some good up-to-date reading on earned income tax credits and minimum wage (especially commentary) in Canada, I'd love to hear about it.

Friday, July 28, 2006

Labour shortages & the Keith Richards effect

Now here's my complaint: the media is too busy concentrating on negative protests and sob tails of labour shortages in Bootown, Alberta to concentrate on the labour solutions on the table (never mind the ones not on the table). Case in point: I challenge someone to find a single Canadian-based news item on the current labour negotiations between B.C. and Fijian authorities. Supposedly the two are discussing improvements in labour regulations to encourage worker mobility.

Global Insight (19 July 2006: sorry no link) has this to say:

As reported by Radio Australia today....

That's right. Australia. Good job, friends.

.... the Canadian province of British Columbia has expressed interest in hiring Fijian citizens in the local tourism industry to ease labour shortages. The employment opportunities, which resulted from Fiji's high commissioner's, Jesoni Vitusagavulu, visit to the region last June, includes positions as cooks, house maids, hotel and restaurant waiting staff, as well as farm work, including berry and fruit picking. The two countries are currently in talks negotiating conditions, which make it financially feasible for Fijian citizens to seek employment in Canada. This is especially viable, given that current opportunities are only up to three months, with maximum wages of US$10 an hour, which are hardly able to offset the high air fares between the two countries.Significance: Fiji's negotiations with Canada are an example of the current structural shift the country is undergoing.

As traditional sectors such as sugar and garments decline, the country is forced to seek alternative foreign exchange earners to sustain import capacity and external balances. Aside from tourism, workers' remittances have become an important source of such and are expected to gain increased importance.

And, according to the Pacific News Agency, “Australia, which is the main beneficiary of the Fijian brain drain and trade has shut its doors on its Pacific Island neighbour.”

B.C. isn't alone in wanting to attract immigrants to fill empty jobs. Alberta too has been thinking strategically about labour solutions, but it has yet to outline a definitive plan. Unless that one got by the media, too.

Maybe I should lay off the Canadian media. Perhaps it's not the case that they're too obsessed with juicy bits of drama to be informative. Perhaps we simply don't care enough about Fiji. Yeah, that's it. Back in May a letter to the editor of The Globe and Mail had this to say:

Perhaps we'd be more introspective if Keith Richards were tossed from a Canadian pine by a Fijian immigrant...?Keith Richards's fall from a tree at an exclusive resort in Fiji has, inadvertently, brought that country to the attention of the North American news media. It's curious what stories the media have ignored: the election in Fiji that begins this Saturday; last month's visit to Fiji by the Chinese Premier; the success of Fijian rugby players on the world stage.

Wednesday, July 26, 2006

graphs

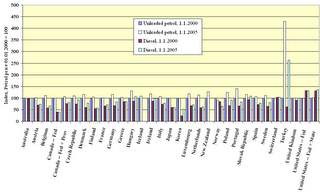

1st graph: Turkey is the largest bar;

2nd graph: Turkey is again king;

3rd graph: Turkey's the insignificant smidget fifth from the right

My blogging can only improve at this point, yes?

Taxes in Turkey

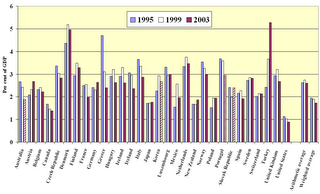

Check out Turkey. The graph, taken from the OECD website, is accompanied by this blurb:

...developments in the nominal tax rates for unleaded petrol and diesel in each country, expressed in national currency, between 1.1.2000 and 1.1.2005 are illustrated. Each bar represents an index, where the tax rate for unleaded petrol as of 1.1.2000 is set equal to 100. One can notice the very strong increases that have taken place in the nominal tax rates for both unleaded petrol and diesel in Turkey. No correction is, however, made for inflation over this period.

It's helpful to know that Turkey's population was 68.6 million in 2002; its GDP was $183.1 US billion; and its consumer price inflation was 45% (Data from The Economist Intelligence Unit).

Below are two other interesting graphs.

This graph shows revenues from environmentally related taxes in per cent of GDP:

And finally: Revenues from environmentally related taxes per capita. Again, notice Turkey.

The Economist Intelligence Unit provides some good data comparisons (GDP, population, inflation) among a few countries here. I'd like to explore the explanation behind these graphs when I have more time. The OECD warns that these graphs should be interpreted cautiously. More info on them can be found here.

do-gooders and television subsidies

A number of Canadian public figures are turning a new leaf and devoting themselves to a single cause. I'm most interested to learn about Roy Romanow's Canadian Index of Well-Being. This article doesn't have much to say on it, but it highlights the actions of a few do-gooders from Canada's political circles.

The Toronto Star tells us that the U.S. plans to offer subsidies to convert old TVs.

The U.S. administration wants to spend $1.5 billion (U.S.) to help about 16Article is here.

million households buy television converter boxes to ease the transition to

digital TV in 31 months.

Amendment: Ah-ha! I've caught a big fat slip-of-tongue on this post and I've deleted it. I guess that's what I get for posting on the run.

Tuesday, July 25, 2006

In favour of $100 blanket coverage

I'm going to adopt an argument in favor of the $100 blanket coverage.

First, women's supply of labour tends to be fairly elastic (their preferences are increasingly in favour of market work over leisure or household work). It's unlikely that a woman would decrease her hours of work after receiving a benefit cheque, but a large enough benefit cheque is believed to deter an unemployed person from offering work for a labour wage if it puts them on a high enough utility level.

Second, studies have shown that primary caretakers who work less than 10 hours per week can pay up to three times more for childcare than those who work more than 10 hrs per week (Ehrenburg et al, 2004: p.218). This is because daycare costs are sometimes quasi-fixed. Two hours of daycare per day out of a grand total of two hours can be more costly than two hours of daycare a day out of a total of eight hours. The point is, how would we decide on the eligibility of cheque recipients?

In praise of blogging

Monday, July 24, 2006

Cheques vs. National Childcare

At this time, I have no opinion on the policy adopted; however, since the government's alternative choice was to implement a national childcare program, I thought it would be worth exploring some of the criticisms that we would have been hearing if “the multibillion dollar plan” had been adopted.

A NBER working paper by Michael Baker, Jonathan Gruber, and Kevin Milligan (Dec. 2005) highlights the following criticisms about national childcare systems:

1.

”...It is possible that publicly-provided childcare simply 'crowds out' the private provision of care, with no net increase in childcare use or labor supply to the market.”2.

“Public systems require extensive public funding, which comes at a cost of higher taxes and therefore reduced economic efficiency.”

3.

“Finally, it is also possible that time spent in childcare, with many children per caregiver, is worse for children than time spent with parents at home.”

The authors observed that “Quebec's universal, highly-subsidized childcare in Quebec in the late 1990's”...”led to more hostile, less consistent parenting, worse parental health, and lower-quality parental relationships.”

So, there are some arguments against the flip-side. The NBER paper I cited from, “Universal Childcare, Maternal Labor Supply, and Family Well-Being."

I'm interested to learn more about the plausibility of the crowding-out effect, so I might post more on that subject later.

Sunday, July 23, 2006

'Capacity to innovate'

Here's an excerpt from the article:

Researchers from the Maritimes, Ontario, Quebec and western Canada will study 22 clusters within seven newly emerging and traditional industry sectors across five different regions. Industry sectors will include biotechnology, multimedia communications, photonics, wood products, and the wine industry.

"By pin-pointing the synergies between business, government, and research institutions, we hope to be able to improve a region's capacity for innovation," says [Adam] Holbrook, who will lead the national team investigating aids and barriers to innovation in biotechnology. "At the end of the day, this study must come up with specific results that are of use to policy makers. If, as previous research suggests, the approach to innovation varies across Canada, we must determine how to help those regional systems work together rather than fracture apart. We must be sure that a one-size-fits-all policy to promote innovation does not hinder this across the country."

The whole article can be found here.

Meet the Friedman's!

Housing: CMHC & econ stability

I questioned the reasonability behind it in an earlier post. Then a Globe and Mail editorial went as far as to say, "The agency should get out now -- before the going gets tough -- and leave the Don't-Pay-a-Cent events to the private sector.” That's a pretty extreme opinion. But there's definitely something amiss and I'm not ready to let the issue die just yet (but soon, I promise).

The CMHC is exercising its right to remain competitive among the growing number of packages offered by lenders. Meanwhile, as I noted earlier, “housing wealth reduces saving by more than other kinds of financial wealth” (Sorry my source is missing). Can the CMHC compete without creating a negative effect on the economy? I believe this depends on three major things, all else being equal:

1. Asymmetry of information;

2. The expectations that borrower's have of the future; and,

3. David Dodge

I'll explain. But first some background from Globe and Mail columnist Rob Carrick (subscription required):

Interest-only products account for about 20 per cent of the U.S. mortgage market, so they're nothing new. With the Canadian version, the benefit is that you have a reduced payment comprising interest but not principal for a period of five or 10 years (you'll have some leeway to pay down the principal if you want). At the end of five years, you start paying both principal and interest at a rate pegged to a 20-year amortization period. With the 10-year interest-only option, you move into a mortgage with a 15-year amortization period.First, as long borrower's know what they're getting into, as long as information is symmetric, it's more likely that borrower's and lenders will be matched appropriately. To a degree this would depend on the standards of credit that the CMCH places on borrowers. Keep in mind, they want to pull a profit.

What you're essentially doing with both these mortgages is shoveling money into interest payments that do nothing to reduce your debt. When you eventually start making blended payments of interest and principal, it'll be as if you're starting fresh in a new mortgage with a repayment schedule that's more aggressive than the traditional 25-year amortization period. Will you be able to afford the much higher payments?

Second, the effect of the package depends on the expectations that borrowers have of the future. If people don't expect to be moving up in the world, they'll think twice about signing up for the plan. Carrick notes that the plan could make sense for some people (ie. people who expect to be moving from one income to two); however...

...economist Benny Tal of Canadian Imperial Bank of Commerce.... said that in this environment of increasing economic globalization, wages aren't rising as much as they used to. “It's very unlikely that many of the people who cannot afford [a house] now will be able to afford it five years from now.”And third, what does David Dodge think? It's no secret that the media likes to put a dramatic spin on things. Perhaps Dodge isn't as outraged as we're led to believe. After all, he has a job to ensure that the CMHC knows what it's doing.

Is this new package worth the risk? I wonder if we'll be seeing some adjustments in the relations between the CMHC and the Bank of Canada. Perhaps the Globe and Mail editorial wasn't so rash.

Saturday, July 22, 2006

New Brunswick's unemployment dilemma

Using the service industry as an example, B. Ferguson shows how an increase in the minimum wage may not necessarily lead to a substitution or an income effect in hours of work decisions, meanwhile labour force participation may increase as reservation wages are met. But wait! Then there's migration to consider. And the discouraged who leave the workforce...

I read elsewhere that studies have shown that “the number of people moving with a job already in hand is three times as large as the number moving to look for work” (Modern Labour Economics, Ehrenburg et al: 2004). Whether this is the case in NB, I don't know. Still, egad. What a mess.

Prof Ferguson writes:

It's separating out the various demand and supply factors like these which makes empirical economic analysis the thrilling, heart-pounding business it is (no, really - why are you looking at me that way?).Well, as long as my anonymity is maintained, I'll admit that I agree!The whole piece is here.

We are the champions!

It doesn't help that global warming sounds like good news in a country of interminable winters.

Right. Moving on....

The political task is almost as daunting. Several provinces have plans to reduce

emissions, but all have different priorities. Alberta, the prime minister's adopted home province, is a big emitter because of its coal-fired power stations and energy-guzzling production of oil from tar sands. In contrast, Quebec relies on hydro power and encourages public transport. Mr Harper needs to do well there if he is to turn his government's current minority status into a majority at the next election.As for business, the degree of resistance to emissions curbs varies. Abitibi-Consolidated, a big paper producer, has already cut emissions from its Canadian mills to 42% below 1990 levels. But energy efficiency in the oil and gas industry has plummeted because companies in Alberta's oil sands use large amounts of natural gas to extract oil.

There is no shortage of suggestions for a new set of policies. Most borrow from international experience of pricing air pollution. The C.D. Howe Institute favours a carbon tax, compensated by cuts in other taxes. Another possibility is to use provincial schemes as building blocks for a national effort. Alberta and Quebec have already set up company registries for emissions, says Daniel Schwanen, an environmental analyst. It would cost Ottawa little to make them compatible.

Mr Harper could also look to the government's own advisory body, the National Round Table on the Environment and the Economy, which reported last month that emissions could be reduced by 60% by 2050. Technology is not the problem, said the report. What is needed is a clear signal from the government that it is serious about climate change.

The article also gave a brief mention of The Montreal Exchange's newly-announced credit-trading scheme for carbon-dioxide emissions. Details are still pretty unclear, but I look forward to learning more about it.

Friday, July 21, 2006

Explicit numerical definition for the price stability objective

This nomenclature issue is particularly important to the Federal Reserve because of its dual mandate to promote both “stable prices” and “maximum employment.” That may be why Ben Bernanke, while a Fed governor, decided not only to drop the IT name, but to state categorically that “what I am suggesting is not equivalent to inflation targeting.” That was a wise decision on his part. In the U.S. context, the term “inflation targeting” is a political and public relations burden and is therefore best dispensed with.

Janet Yellen takes a similar position. [She said,] “I, for one, am not a strict inflation targeter…and—as far as policy-makers go—I do not think I am in a minority. A natural next step for the FOMC is to announce an explicit numerical longrun inflation objective.”

Here again, the distinction is drawn between “inflation targeting” and announcing a definition of price stability.... It is therefore not surprising that the FOMC, in the minutes of the July 2005 FOMC meeting, describes the debate as being about whether or not to provide an explicit “numerical definition for the price stability objective.” The minutes never mention the words “inflation targets” or “inflation targeting.” The bottom line is that if Bernanke is to move the Committee towards an explicit numerical definition of inflation, he will have to differentiate it from the IT.

1. Numerical inflation targeting; and,

No wonder supporters of a “price-targeting path” don't want to use Bernanke's terminology. The terminology itself would at first glance make their argument seem pithy to those who are confused about Bernanke's proposal (and I think it's safe to assume that most people are).

Thursday, July 20, 2006

'Frameworks': The lost paper by Ben Bernanke

From Bernanke and Mishkin's paper, here is an example of a flexible inflation targeting framework in action -- a demonstration of how flexible inflation targeting 'can adjust to accommodate supply shocks or other exogenous changes in the inflation rate outside the central bank's control':

[Consider] Deutsche Bundesbank's practice of stating its short-term (one-year) inflation projection as the level of “unavoidable inflation.” In the aftermath of the 1979 oil shock, for example, the Bundesbank announced the “unavoidable” inflation rate to be 4 percent, then moved its target gradually down to 2 percent over a six-year period. In other cases, the central bank or government makes explicit an “escape clause,” which permits the inflation target to be suspended or modified in the face of certain adverse economic developments.

To be fair, perhaps the term “numerical inflation targeting” is often used loosely. Perhaps others don't see the merit in making a distinction.

On July 13, John Taylor had this to say in the Washington Post (excerpt via Greg Mankiw's blog):

Some have argued that the lesson learned from this recent volatility experience is that the Fed should set a specific numerical target for inflation. I disagree; recent experience indicates setting such a target could increase volatility again. First, we do not know what inflation rate to target. If we choose one, we might have to change it later. Second, an explicit focus on the inflation rate may actually take emphasis away from price stability. Focusing on a numerical inflation rate tends to let bygones be bygones when there is a rise in the price level. In recent research, Yuriy Gorodnichenko and Matthew Shapiro of the University of Michigan found that Mr. Greenspan placed relatively greater weight on the price level than on the inflation rate in speeches: He was twice as likely to mention the price level as inflation; Mr. Bernanke was half as likely to mention the price level as inflation.

In sum, powerful lessons can be learned from Mr. Bernanke's start. Keep to the proven principles. Talk about the economy, not about the future of the federal funds rate. Commit to price stability without adding uncertainty about the meaning of a new inflation target.

Taylor's article expresses criticism against numerical inflation targeting, not the flexible framework discussed by Bernanke.

Bernanke and Mishkin's paper is worth reading and can be found here.

Wednesday, July 19, 2006

Economic analysis and political feasibility

I found three economists who explored this subject in 1972: Milton Friedman (“Have Monetary Policies Failed?”), John Gurley (“Have Fiscal and Monetary Policies Failed?”), and Arthur Okun (“Have Fiscal/Monetary Policies Failed?”). The trio hold distinctly different viewpoints.

Economic policies are tools used to meet the needs of the U.S. government's capitalist agenda, says Gurley. When the government is behind the wheel, capitalist objectives guide policy decisions, and “...other claims...are judged by the extent to which they are compatible with private profit making.” Gurley implies that as long as the government has control over economic policy, such policies will never be used with the direct attempt to improve social welfare, the environment, or anything else beyond corporate profits.

Okun agrees that the government chooses policies based on their ability to raise corporate profits. That is precisely the point, says Okun. Social welfare is not an ultimate objective to such policies. It is only through the regulation of aggregate demand that fiscal-monetary policy contributes to social welfare. Furthermore, Okun lamely adds that profits can never solve our “...lofty principles of equality....”

Neither Gurley nor Okun are ecstatic about the record left by fiscal-monetary policy. Okun believes that the policies are not fulfilling the needs of the government, while Gurley contends that these policies meet the needs of few else, save private firms.

Okun might say that it is not applicable to argue about a gap between social welfare and capitalistic objectives, but he admits that there is a “persistent gap between economic analysis and political feasibility.” Friedman would likely agree with Okun's latter point. He expresses that economists should work within their capabilities and ignore the pressures put on them by politicians.

Not only does Friedman admit that the government is a negative prescence hovering over monetary policy, but he concludes that it may be for good reason that the government's prescence exists. Partly due to political pressure, economists consistently over-promise and under-deliver, hurting the economy and the profession of economics. He implies that this is a cause and effect of political pressure. A vicious cycle, perhaps.

Friedman states that, like the pressure that exists from the government, pressure from the public might also exist for good reason. Again, economists spread false expectations; they over-promise and under-deliver. Friedman's advice to economists is that they should be honest about their capabilities and ignore the pressures from the government and the public that lead them to trumpet over-optimistic forecasts.

A counter-argument to Friedman's comment would be to say that pressure encourages responsibility. Surely Gurley would have thought so when he wrote his paper.

So, should economic policy be driven by more than just profits? Should economics be more than a quantitative science? We seem as indecisive as we were 34 years ago.

There are some good comments on this subject over at Economists' View.

The Long Tail - selling less of more

"In the worlds of entertainment and information, we've already lost the capacity constraints of shelf space and channels, along with their one-size-fits-all demands," writes Anderson. "Soon," he continues — and this is the killer app in his narrative — "we may lose the capacity constraints of mass production, too.

The explosion of variety we've seen in our culture thanks to digital efficiencies will extend to every other part of our lives." If that sounds a little like Economics 101, Anderson easily pushes readers past such barriers by describing a statistical curve in which "the tail of the curve is very long relative to the head." Example: Anderson graphed music downloads from Rhapsody, an online music company. Predictably, a few mega-hits — Anderson does not say which — were downloaded in the mega-thousands. The graph then falls off steeply into the territory of less popular tunes. "But the interesting thing," writes Anderson, "was that it never fell to zero. I'd go to the 100,000th track, zoom in, and the downloads per month were still in the thousands."

The curve, like the battery, just keeps on going, fuelled by demand that, as Anderson says, was previously dismissed as beneath the economic radar.Even though the long tail does, eventually, run out — Rhapsody's inventory sits at about 1.5 million tracks — the old notion of supply and demand has been upended. The new shape of demand in our culture can be seen, writes Anderson, "unfiltered by the economics of scarcity."

Flipping for a moment from music to books, we see how fully one-quarter of the sales at Amazon, the online book retailer, comes from books not on the list of top 100,000 titles, causing Anderson to quote venture capitalist Kevin Laws: "The biggest money is in the smallest sales." Hence the book's subtitle.

What this all means is a great deal. We are witnessing a new economic model — one that we see now in media and entertainment industries but which, if Anderson is right, will become widespread.

The benefit to consumers is an abundant marketplace. "You can find everything out there in the Long Tail," writes Anderson. (Well, not quite everything. WKRP in Cincinnati is unavailable on DVD due to the prohibitive costs of licensing the show's classic rock music. Thus there exists a real scarcity where Fred Willard retrospectives are concerned.)

Freed from what Anderson calls the "tyranny of lowest-common-denominator fare," consumers thus roam a market that has become fragmented into a long tail of a million niches.

There are other examples — the self-publishing success of Lulu.com is another cited by Anderson — to make the point the Long Tail equates to infinite choice. Our interests, says a media analyst quoted in the book, have always been fragmented. But those scattered desires have not, in the past, been met. We have been told what we like.

The trick in Long Tail lies in making the convincing argument that this new economic

paradigm applies outside of the realm of iTunes and Internet book ordering.

Women in academics

1.

Evidence is showing that women are blowing the socks off of men in North American post-secondary institutions. There are several takes on this. Economist Richard Posner expressed his controversial view the other day.

2.

Here is a random statistic I find impressive: According to the 2006 annual report filed by Dalhousie University's Economics Department, 40% of their permanent full-time faculty members are women. The report claims that this gives Dalhousie “one of the highest, if not the highest, proportional representations of women in a Department of Economics at the university level in North America.” I wonder what the trend is at other universities, particularly in the sciences.

Tuesday, July 18, 2006

Easterbook's Law

You get the picture. One story even warned readers, “Booze buyers beware: July 1 GST cut could actually hike price of spirits.” It wouldn’t do anything of the kind, of course: the rise in booze prices, as logic would suggest, was due to an increase in another, entirely separate tax. But it fit the prevailing media frame, that the GST cut was much ado about very little, if not an outright con job. Or as a Vancouver Sun story groused, “GST cut won’t benefit people on pensions.” (Why? Because it would lead to lower prices, and therefore a smaller adjustment for inflation. Oh my.)

This remarkable waving away of what would otherwise appear to be a sizeable windfall for consumers is in part a variant of Easterbrook’s Law, named for the American journalist Gregg Easterbook, who first conclusively proved that all economic news is bad: all news means change, and all change, no matter how broadly beneficial, makes some people worse off -- who are invariably the focus of media attention. In the case of the GST cut, troublingly, there are no losers, so the media instinctively switched to the next best thing: the winners don’t benefit as much as all that.

I'll comment on this subject later. But for now I'll echoe Mike Moffat's sentiment:

Easterbrook's law is alive and well in Canada. It's funny, pretty much every proposal I've seen that would help Canada meet it's Kyoto targets has been dismissed by newspapers that support Kyoto, such as the Toronto Star. Why? Because of Easterbrook's Law. With a detailed policy proposal, you can always identify someone who is going to have to pay more for electricity or gas or will be made worse off in some manner. But if you leave the discussion fairly general "we should cut emissions!" without specifying how, those progressive newspapers seem to be for it, because you cannot identify the losers. Easterbrook's Law in action.

Monday, July 17, 2006

Returns to prestige

What might well be true is that the returns to education have become increasingly non-linear: The most educated are now getting a bigger return from a marginal year of education than those with moderate amounts of education. In other words, two years getting an MBA from Harvard Business School may increase a person's income more in percentage terms than does two years getting an Associate Degree from Mass Bay Community College. My understanding from my labor economist friends is that some evidence favors this hypothesis of increasing nonlinearity.

To some extent, the returns to human capital are random (as is true of physical capital). Getting an MBA gives you a shot at being CEO, but it is not a guarantee. This may be part of the Lemieux finding that higher levels of education are associated with higher residual variance. And perhaps it can reconcile the differing perspectives of Krugman and Lazear.

Perhaps returns to education are not as "random" as we might think. To add to Prof Mankiw's hypothesis, I suspect that monetary returns to institutional-derived education are becoming nonlinear while (labour wage) returns to prestige are becoming increasingly linear. Prestige in this sense would be measured as a function of the prominence of the educational institute attended, the prestige of a person's relations, society's determination of prestige, and so on.

A criticism that has been expressed of Prof Mankiw's hypothesis is that returns to skill (perhaps as a function of IQ, training, etc...- assuming “skill” could be accurately calculated), contains more information than returns to education. I agree but disagree. If an employer could learn about the skills of the workforce (ie. if it was efficient and affordable to do so), he/she would would likely use this information instead of hiring based on education. However, in a competitive labour market, employers have a good chance of gaining qualified candidates if they simply advertise for graduates from prominent universities. And they do.

I believe that there would be a benefit to looking at more than returns to education. Why? There are too many categories and determinants to entertain, and too many qualifications to make. For example, why should education be measured only in years when two years at Harvard offers greater returns than two years at Bunghole Community College? To put it another way, could you measure returns to gas on the growth of a flame? Not if you knew the difference between oxygen and methane. You could, however, measure the returns to each gas separately. But then, what would be the point in generalizing gas' influence on a flame? Instead, you might want to know what's in the gas that causes a flame to burn higher. Let's leave this bad metaphor. What I'm saying is, it's worth considering what a Harvard graduate and a Princeton graduate have that a graduate from Bunghole College doesn't have.

i) Perhaps they obtained relatively better skills from their education, but (once again), we're assuming that employers are not able to determine which candidates have the most skill. It's not efficient. It's much more efficient for them to hire based on...

ii) Prestige! People who graduate from prominent universities increase their personal prestige. As I see it, this latter point has become increasingly important in the labour market, more so than a general education.

One argument I foresee against my hypothesis would be in the case where a person is prestigious and stands to inherit a fortune. Evidence shows that people who expect to receive a large bequest often work less, perhaps because they have no incentive to work (Douglas Holtz-Eakin et al: 1993). In this case, the (labour wage) returns to prestige would be low; however, such situations would become the outliers. Linearity would surely still be stronger than in the case of measurements of monetary returns to education today.

In sum, I hypothesize that returns to education are becoming increasingly nonlinear and monetary returns to prestige are becoming increasingly linear. Looking at the potential nonlinearity of returns to education is interesting, but I think prestige is what is sucking up the linearity.

I invite criticism and knowledge!

Returns to education

He also catches Paul Krugman contradicting himself, which is amusing, yes?

Housing matters returned

Today the Globe and Mail ran a good editorial on the CMHC's decision and what it means for the economy. The article follows the sentiment I expressed earlier, but the author's recommendation is blunt: "Such mortgages are risky for the buyers and their backers. The agency should get out now -- before the going gets tough -- and leave the Don't-Pay-a-Cent events to the private sector. "

Here is an excerpt:

Bank of Canada Governor David Dodge personally chastised CMHC officials for their folly last week. As Mr. Dodge told a news conference before his private meeting, insuring interest-only mortgages could actually drive up housing prices, fuelling inflation. "We'll have to see, but if we look elsewhere in the world where there has been a major move to interest-only mortgages or other innovations of that sort, that has had an influence on housing prices," he warned. That would work against CMHC's avowed purpose of ensuring that home ownership is more affordable and accessible.

CMHC announced the scheme with little fanfare in late June. As it explained, it now insures interest-only mortgages for borrowers "with a proven history of managing their credit." It provides the example of young people "who may prefer more cash-flow flexibility with some of the upfront, one-time expenses associated with the purchase of their first home." In the real world, that is called Storing Up Trouble, because after the 10-year grace period those buyers will eventually have to pay off the principal, too. And that means higher monthly payments.

Canadians are already out on a credit limb. Although their assets considerably outweigh their liabilities, in the last quarter of 2005 individual Canadians and unincorporated businesses owed a stagger-ing $992-billion, including $597-billion in mortgage loans and $265-billion in consumer credit. That amount was 5.6 per cent higher than third-quarter debt. In other words, we have been on a spending spree. There are signs, however, that we are coming back down to earth. Statistics Canada has calculated that the savings rate was 1.9 per cent of personal disposable income in the first quarter of this year. Canadians are no longer dipping into their savings. The red-hot housing market, with the key exception of Alberta, is slowing down; the average number of housing starts in the second quarter dipped 9 per cent below the first quarter. With the Bank of Canada's key policy rate at 4.25 per cent, housing prices are no longer skyrocketing.

Life is relatively stable. So why has CMHC abruptly decided to insure the riskiest mortgages, backed with Ottawa's clout?

The link to the article is here.

Sunday, July 16, 2006

Economic modelling

Ben Muse excerpts the article and points to a relevant piece written by Kimberly Ann Elliott on trade negotiations.

Economists who kick things

Adbusters magazine selected a cross-section of “economists” and asked them a loaded question: “How can economists justify their refusal to address the environmental problems they are complicit in?” Robert Costanza, John Raulston Saul, Paul Ormerod and others respond.

I think David Colander says it best:

"Economics weeds out people interested in the broad picture. Someone interested in bigger policy issues will probably never choose to go to graduate school in economics, and won't make it through if they do."

I've noticed a few good posts on this subject in the blogosphere. Worth mentioning:

Marginal Revolution has categorized the type of people who succeed in economics; and, Greg Mankiw addresses the trade-off that economists face between “breadth and depth.” It's easy to see why this man is so well-liked.

Saturday, July 15, 2006

"a game of chance where you have no chance"

Someone has pointed out to me that there was once a boardgame named 'True Dough Mania'! Ha. I like that. Thank you for the info!

Hedge funds bet on hurricanes

Nevermind stocks, this guy is betting on hurricanes.

h/t to James Altucher at The Daily Blog Watch

Housing matters

The news from CMHC comes at a time when some economists say Canadians are apparently already not saving enough (notably young families). Add to this what we know from history: housing wealth reduces saving by more than other kinds of financial wealth.

Also, from what we already know, low long-term interest rates and easily accessible housing means people tend to stop saving from their current income. We've seen a strong case of this in the U.S. (although the situation appears to be cooling).

After the CMHC announcement David Dodge expressed his concerns of spiraling inflation. CMHC offers assurance that the new program will not change the qualifying criteria for a mortgage.

Whether the qualifying criteria is changed or not, attractive deals have a strange knack for spurring demand. Go figure.

Something I enjoyed reading: Mark Thoma noted some advice given to the Fed by Robert Reich as the U.S. housing boom appeared to begin its slow-down.

Farms face 'economic euthanasia'

Prior to the Great Depression, Saskatchewan was the third most populous province. Today, with a population teetering around 1 million, it is sixth. All it would take is another museum of Highland dancing and Sunday shopping in Nova Scotia, and Saskatchewan would fall to number seven.

There is a list of reasons for the decline of traditional dryland agriculture on the Canadian prairies. A long downward trend in grain prices, an equally long upward trend in input prices, and generally lousy growing conditions have made the traditional family farm a decidedly losing proposition. Global commodity prices are falling because of the vastly increased grain output in places like Argentina, Brazil, Australia and Ukraine. Once these countries caught up with modern machinery and more productive farming techniques, Canada started getting its agricultural butt kicked. Face it — we are halfway to the North Pole and can't compete with the South American sunshine. On top of it all, outrageous farm subsidies in the U.S. and protectionist policies in Europe have ensured that the world is awash in low-price grain. Unfortunately, the agricultural vote in all three Prairie provinces punches far above its weight.

Rural areas in all three provinces are more heavily represented in the legislatures than are the urban ridings. This has made for strong and predictable political support for agriculture. But the phrase "support for agriculture" is really code for "gobs of taxpayer money." Federal and provincial agricultural policy has been largely that: relief money for drought, relief money for floods, and a series of cash bailout programs often for no good reason at all. (And this is setting aside for consideration elsewhere the mess our supply-managed agricultural sectors are in.)

The entire article can be found here.

Thursday, July 13, 2006

Toodle-loo to tightening

The BoC is sticking close to its word: core inflation will average 1.8% in Q2 and 2.0% in each of the next two quarters and throughout 2007.

Some analysts are saying the bank's inflation forecast is too low, while others say it's too high. Yet again TD offers a conservative forecast and BMO shoots high. Let it also be known that TD Security's chief economist and his mom support Dodge's decision to maintain the interest rate. How nice.

On one hand productivity is booming while business investment and consumption move strong. On the other hand, the timely reduction in GST will lower the inflation rate by 0.6 percentage points, says the BoC. Global imbalance and lower import prices will also create downward pressure. The BoC blames the misguided April MPR on the strong trading of the dollar putting a drag on exports.

Goodbye tightening cycle.

Tuesday, July 11, 2006

The 'political/fiscal prisoners' dilemma' over taxes

“...Mackenzie says provinces are under intense pressure to keep their tax rates competitive with one another. With highly mobile companies and individuals prepared to move to the lowest-tax jurisdiction, no province wants to be the first to raise taxes.So, what can be done?

"Provincial governments are caught in a kind of political/fiscal prisoners' dilemma in which no individual province has an incentive to take action which would benefit all provinces if they all did it, [says Mackenzie].”

“Mackenzie dismisses remedies proposed by a provincial report, which called for almost $10 billion more a year from Ottawa in equalization payments to have-not provinces and cash transfers to all provinces, and the Canadian Council of Chief Executives, which called on Ottawa to elminate the GST and let provinces fill the resultant tax void. The first "misses the mark'' and the second is "virtually guaranteed to make the situation worse.''

His report includes two suggestions:

1. the introduction of an interprovincial tax treaty that would limit tax competition among the provinces; and/or

2. the establishment of national “umbrella taxes” which would protect provincial tax room by allowing the deduction of pre-determined levels of provincial taxes from federal taxes payable.

BoC holds rate steady

The Bank's press release says:

More than a few folks will be curious to see the BoC's next inflation forecast (to be released July 13).The global economic expansion remains robust. Growth in Canada in the first half of 2006 appears to have been a little stronger and the Canadian dollar has traded in a somewhat higher range than was envisaged in the April MPR. As well, there was a further shift in the composition of demand towards consumption and away from exports. Total CPI inflation has remained above the 2 per cent target, mainly because of increases in consumer energy prices, while core inflation moved up to 2 per cent slightly sooner than expected. All factors considered, the Canadian economy is currently judged to be operating just above its production capacity.

Will the real minimum wage please stand up?

Over at Cafe Hayek, Don Boudreaux argues:

So, there's Don Boudreaux's argument. He also continues to reinforce it. Egad. My beef is that such an argument ignores the fact that in order to assess the effect minimum wage has on employment we need to consider wages in real terms. Consider that the real wage is W/P. From the period that wages were last set, prices will slowly rise due to inflation, which will lower the real wage while the nominal wage remains the same. By not allowing the real wage to adjust with inflation, minimum wage earners become worse off over time. I won't go on with this, because it's really not so complicated.Most visitors to the Cafe know the familiar arguments against minimum-wage legislation. Allow me here to spin the core argument -- that minimum-wage legislation prices many low-skilled workers out of their jobs -- by wondering aloud if proponents of higher minimum wages would ever make the following claim:

The market prices of most used-cars are too low for sellers of those cars to support their families. This fact is especially true for poor people, who, when they sell their old cars, almost always have only old, high-mileage, often dilapidated used-cars to sell. These people aren't selling two-year-old Lexuses or BMWs. They're selling 15-year-old Chevys and 20-year-old Hondas. So let's enact legislation mandating that no used-car can sell for less than, say, $25,000. That way, anyone who sells a used-car is assured that he or she will earn at least enough money to support a family for a year. I doubt that many people would argue that government should legislate a minumum price for used-cars. But why not? If merely identifying a problem with a low price (such as "At the current minimum wage, even full-time workers can't support a family of four") is sufficient to justify legislative action to raise that price, why won't such action work for used-cars as well as it will work for labor

hours?

Of course, the consequences will be the same: used-cars worth less than the $25,000 will not be sold; the owners of such cars will either remain stuck with them or they will have to spend lots of money and effort repairing and remodelling these cars so that each one is worth at least $25,000 to prospective buyers.

I guess this issue frustrates me because it seems that people who echoe Boudreaux's sentiment are either purposely ignoring the discrepency between real vs. nominal terms to win support for their cause, or they're continuously confused. Or is it me?

Monday, July 10, 2006

Hike or no hike?

TD provides a good overview of the criss-cross of indicators the bank is looking at. Even though TD leans towards a prediction of a hike, their analysis demonstrates how unpredictable the decision is.

Given the mixed results of the bank's indicators and Dodge's pledge of transparency, I doubt he will surprise us with a further increase. But should he? I believe so. Sure, the brunt of Canada's recent core inflation has become evident only recently, but who's to say this isn't the beginning of a longer trend. We shall see...

National Leadership 101: lesson from a magazine

“...there are some big things that Canada continues to get wrong, and other big things that could go wrong without preventive action. In general, Canada still taxes too much. Firms...need positive reasons to invest in a market that is only a tenth the size of America's. This implies that Canada should continue with the tax cuts that Mr Martin launched as finance minister.”

Check. Tax cuts arrived this month.

“Canada...enjoys a free ride in defence from the United States.”

Did Harper not invest much-needed funds into procurement for the Canadian Forces? This is in addition to “an extra C$5.3 billion for defence spending over the next five years.”

“(Canada) needs to work harder than Mr Chretien has done at keeping the trust of the United States.”

Only last week President Bush was complementing “Steve's” effort to beef up border security. Bush also seems content with “Steve's” eagerness to come to an agreement over the softwood lumber dispute.

“At some point, however, [tax cuts] will damage the welfare state on which Canadians set such store....To keep its new cool, Canada must therefore overhaul the way its government allocates power and money.”

Beginning last month, families could begin claiming $100 per month for each child under the age of ten. I found this to be a surprising move and I'm interested to see the impact it may have on the labour force for women in low-skill jobs in particular.

The Economist applauded Canada because, “While other rich countries suffer a racist backlash over immigration, Canadians welcome migrants and are proud of their tolerance and cultural diversity.”

The Conservative's seem to play into this, too. Harper issued the first formal apology to Chinese immigrants for the racist actions made against them upon their immigration to Canada years ago.

In fact, there is only one criticism in the entire article that has not been touched by the party:

“Without an effective opposition, much of the job of holding the government in check falls to the judiciary, policing a Charter of Rights which on one view, unlike America's Bill of Rights, tilts too far towards the rights of groups rather than individuals.”

Of course, the ineffective opposition at the time were the Conservatives! And so, what does The Economist have to say about the Conservatives now? If Harper hopes to turn his minority government into a majority, articles in The Economist would lead us to believe that Harper has at least one magazine's support. Or, perhaps the magazine has his studious support!