A new inflation target?

With the expiry of the inflation-control agreement held between the Bank of Canada and the Government of Canada arising this December, people are talking.

Some background from the BoC:

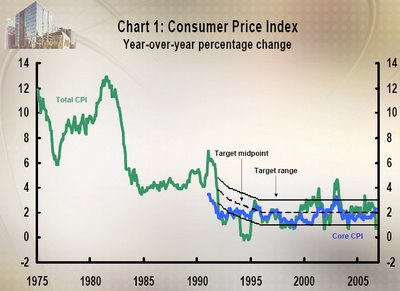

In February 1991, the Government and the Bank introduced targets aimed at reducing the rate of inflation. The objective was to achieve a 3 per cent inflation rate by the end of 1992 (the lowest inflation rate in almost two decades) and to gradually reduce the rate of inflation to 2 per cent by the end of 1995. The targets were extended twice—first from the end of 1995 to the end of 1998 and then from the end of 1998 to the end of 2001. Both extensions involved maintaining a target range of 1 to 3 per cent with a midpoint of 2 per cent.

Graph Source: Government of Canada

Graph Source: Government of Canada

Pierre Fortin, an advocate of the theory of downward nominal-wage rigidity, says it should be raised to three per cent (Fortin, P. 2001. "Inflation Targeting: The Three Percent Solution." Policy Matters 2: no.l, Institute for Research on Public Policy). This is unlikely to happen though. The BoC maintains that “the argument for the effects of downward nominal-wage rigidity is not a persuasive one in deciding on an appropriate inflation target.”

David Laidler of UWO says the rate should be lowered to one per cent.

The Zero Floor on Nominal Interest Rates

A number of authors have argued that the zero floor on nominal interest rates prevents real (that is, inflation-adjusted) interest rates from falling far enough when inflation is below its target, thus leading to a prolonged period in which the economy is weak and inflation remains below its target. After reviewing the evidence, including importantly Black, Coletti, and Monier (1998), and the papers in Fuhrer and Sniderman (2000), Bank economists Amirault and O'Reilly (2001) conclude that most researchers would estimate the probability of hitting the zero floor as negligible for an inflation target of 2 per cent. Moreover, although this probability rises at an increasing rate as inflation falls, their evaluation of the empirical literature is that there would be only a slight increase in the probability as one moved down to a 1 per cent inflation target. This latter conclusion is less widely held. Some authors are more cautious regarding the proposition that the probability increases only slightly, in contrast to Parkin (2001). As well, Parkin notes that the work of Reifschneider and Williams (2000) shows that explicitly taking into account (in various ways) the zero floor in the central bank's reaction function for setting interest rates significantly lowers the cost of hitting the zero bound in the unlikely event that it is hit.

Potential Risk of a Costly Deflation

Mishkin (1997, 2001) has emphasized the importance of avoiding deflations because of their cost. It is important to distinguish at the outset, however, between an unexpected price decline (of, say, one year in duration) and a persistent deflation. It is also necessary to note that there are costs whenever consumers, firms, and financial institutions are adversely surprised. An unexpected price decline of, say, 2 per cent with an inflation target of zero is no more costly than a temporary drop in the inflation rate to zero for a year with an inflation target and expected rate of inflation of 2 per cent. On the other hand, a deflation with some persistence will be more costly than a reduction in inflation of the same size if it causes problems to arise either from hitting the zero floor on nominal interest rates or from downward nominal-wage rigidity. For example, persistent deflation at 2 per cent per year when the inflation target is zero would be more costly than inflation persisting at zero when the inflation target is 2 per cent only to the extent that its persistence becomes more prolonged because of those two problems. But it is important to note that central bank targeting of a specific inflation rate provides a high level of protection against persistent deflation.

We conclude from this analysis that the serious problems come from persistent deflation, that they stem from the first two factors discussed in this document, and that they are unlikely to arise under explicit inflation targeting.

No comments:

Post a Comment