If you guessed that there will be no computers, you're right. But I'll be back and blogging again in four days or so.

Happy holidays and all that jazz!

a student's thoughts and analysis on economics from above the 49th parallel

If you guessed that there will be no computers, you're right. But I'll be back and blogging again in four days or so.

Happy holidays and all that jazz!

Posted by

true dough

at

3:45 PM

2

comments

![]()

This paper analyses the aggregate relationships between traffic accidents and real economic activity in Spain during the last 30 years. Our general approach is based on two basic assumptions: (1) the number of accidents depends on the use of cars and other exogenous variables, and (2) the level of economic activity affects variation in the stock of cars, as well as degree of utilization. We propose a novel turning point characterization for monthly seasonal data that allows to check whether economic and road accident cycles coincide and, to date the beginning and end of their respective cycles. Empirical results from this section are important in establishing posterior causal models and whether or not economic activity and road accidents have a common component in the long run and a varying lead-lag relationship, depending on the cycles. These models will be the basis to check when Spain will achieve the European Union figures in terms of the fatalities/accidents ratio under different scenarios. Empirical results as well as historical experiences from other European countries proved that reducing fatalities is not only a question of diminishing accidents rates.

Posted by

true dough

at

11:11 PM

0

comments

![]()

CIBC's Avery Shenfield was feeling a little artsy when he published the bank's latest weekly forecast. Here's an excerpt from his rendition of 'American Pie':

A long, long time ago…

I can still remember, how the data used to make us smile

And I knew that if they had the chance

That stores could make the shoppers dance

And, maybe, they’d be happy for a while.

But housing prices made them shiver

With no more tax cuts to deliver

Bad news on the wealth front

It couldn’t be much more blunt

I can’t remember if I tried

To have my VISA charred and fried

But something hit me deep inside

The day, the house boom died.

So buy, buy, the consumer won’t buy

Leaving Chevys at the levee

And Ford sales running dry

And Wall Street boys were drinking Perrier and ryeSinging this will be the day that I die

This will be the day that I die.

Posted by

true dough

at

1:17 AM

0

comments

![]()

In my view, we should be taking a lesson from Egypt when it comes to dealing with tax evasion. I'll explain.

Even though pre-tax wages will adjust to equalize after-tax wages, too many resources, in terms of efficiency, will be allocated to occupations which provide the greatest opportunities for noncompliance. This result also suggests an obvious strategy for the development of an effective tax audit system. One which targets the self-employed in construction and service occupations is likely to be more effective.

...A tax audit scheme targeting groups which have been found to conceal income the most (such as self employed households headed by younger males or those in the construction and service occupations) is likely to be an effective tool in reducing noncompliance.

Clearly, such a policy, if continued for a period of time, would lead to the misrepresentation of occupation and other characteristics by self-employed tax filers to avoid being audited. However, if the information from these audits is used effectively, policies can be designed to reduce noncompliance.

Complicated tax systems can lead to high evasion, even when rates are low. ... A better way to meet revenue targets is to encourage tax compliance by keeping rates moderate.

"The existing culture as far as the tax authority was concerned was a story of predation." says Youssef Boutros Ghali, the finance minister. "Anything the tax authority could squeeze out, it did. But now we have affected a fundamental change of attitude. We have given up predation and established a partnership through a law that is transparent rather than fuzzy and through reducing the tax rate to what people would be willing to part with."

The new law set the top rate at 20 per cent for both individuals and companies, down from 42 per cent. It offered a total amnesty to those who had never filed a return in their lives, regardless of how long they had been earning, if they presented themselves before the end of March 2006.

The law also introduced self-assessment, changing at one fell swoop a system based on the assumption that the tax payer is always a liar, to one in which inspectors have to believe properly-maintained records presented to them, unless they can come up with evidence of wrongdoing.

At the same time penalties for tax evasion have been seriously stiffened. Mr Boutros Ghali says the impact in the first year has been dramatic, with 2.6m returns filed, up from 1.7m in 2005.

The finance ministry had been expecting receipts to drop by 12 per cent in the first year and by 7 per cent in the second before climbing back to their original level at the time the legislation was introduced. Instead, tax receipts have grown by 17 per cent - a reflection of both the wider tax base, and the buoyant economy.

....It is still not uncommon for middle class professionals to argue privately that they should not pay tax, citing examples of official corruption or waste, or to justify tax

evasion by saying that they make no use of the subsidized and generally bad health and education services provided by the government and that, instead, they pay exorbitant fees at private schools and hospitals.Tax inspectors also say that under-reporting is still rife. One cited the example of a doctor who charged him personally $20 when he went for a consultation, but when he filed his return he listed his fee as less than $4.

No one has any doubts that it will take years for a new tax culture to take roots. But there is agreement that new law is definitely a start.

Now Mr Boutros Ghali says that, with an improved computerised system, and freed of the necessity to check the records of every single taxpayer, his 39,000 inspectors will have more time to chase evaders.

Posted by

true dough

at

2:18 PM

1 comments

![]()

Labels: equality, self employment, taxes

Which system of taxation on the self employed evokes the greatest tax distortions?

I) An income-splitting system where individuals may appeal to tax non-compliance; or,

Whether the individual or the household should be the unit of taxation is a long-running debate in the economics literature. One potentially important cost associated with a switch to individual taxation, which has been overlooked in this debate, is the impact of such a move on tax non-compliance. In particular, under individual taxation with progressive marginal tax rates households in which the distribution of income among household members is unequal benefit from attributing income from the higher to thelower income household member. The absence of a third party reporting income enables self-employed households to "split" income among family members to reduce income tax liabilities. Using the Canadian experience as a case study this paper sheds light on the magnitude and nature of this activity by developing a unique estimator of the incidence of illegal income splitting among couples. These estimates provide evidence that the occurrence of income splitting is likely non-trivial and suggest that the costs associated with this activity are potentially significant.

…the raw reported employment rates of wives of self-employed men in Canada are significantly higher than those of their US counterparts. …. No significant difference in employment rates are observed among husbands…. I find strong supporting evidence that the employment differential found among wives is indicative of Canadian self-employed men attributing income to their wives.

…the pattern of income splitting found above suggest that countries that have high marginal tax rates, unequal wages across men and women and high rates of self-employment may find a system of joint taxation optimal, while for those with low incentives for income splitting individual taxation may be more appropriate.

Posted by

true dough

at

7:14 AM

0

comments

![]()

Labels: self employment, taxes

Malls should classify the Santa position as skilled labour, he said, given the job requires skills ranging from acting to psychology.

"Santas encounter stories that cause a lot of emotional distress for Santa and children generally are regarding Santa at that point as psychologist, I suppose," he said. "They're looking to Santa to provide some closure, some comfort and so forth and that's why I say it's a skilled position. If a personal shopper can make $50 an hour I would think that a skilled Santa should also make at least about $50 an hour."

Posted by

true dough

at

7:50 AM

0

comments

![]()

I've made a few discoveries.

Posted by

true dough

at

2:16 PM

0

comments

![]()

Graph via TD

Graph via TD Graph source: WIDE

Graph source: WIDE

Secondly, the richest Canadians are likely to hold a greater portion of their wealth in stocks, relative to lower classes.

TD economists Don Drummond and David Tulk offer their analysis on this:

A distinguishing feature of the 1999 and 2005 wealth surveys is the decline in the real value of stock holdings. As the wealthy hold a disproportionate amount of stocks, the decline in the real value is the principal reason why the concentration of wealth in the highest quintile did not increase by more. If investment returns rise the trend towards growing wealth disparities will likely intensify. This could be compounded by sluggish wage gains in the low end and the financial challenge of immigrants – the main source of growth in the younger, less affluent population.

Net wealth -- non-financial and financial assets minus liabilities -- jumped to 640% of annual disposable income in 2005 from 527% in 2000 and just 370% in 1995, when the country was struggling to emerge from a recession.The surge in wealth in 2005 reflects rising stock markets and once again the positive terms of trade shock where a stronger dollar is making imports cheaper while export prices surge.That appears to more than offset total debt of 126% of disposable income in 2005.

The point is, the source of household wealth differs across classes in Canada.

I have two thoughts on this. First, equality varies across time and space. Placing countries on an ordinal scale seems bizarre (to me, anyway), likewise to drawing conclusions based on "trends." The richest Canadians hold a high portion their wealth in stocks, which vary in their returns across time, therefore "equality" is not a stationary measure. Further, there's of course often heterogenity in the data across regions. Perhaps one of the key benefits of these studies is that they allow us to examine the nature of sources of wealth, rather than pointing us to "trends," or forcing cross-sectional data into ordinal scales where both are inappropriate beyond very general terms.

Second, there are policy implications. By understanding the sources of inequality we can fight the impulse to redistribute wealth based on "trends." Further, it should be perfectly clear to policy makers that the needs of investors should be accommodated (since we know where household wealth is concentrated). Onay oremay orporatecay axestay. Right? Clear.

There's so much to explore on this subject, but I'll quickly note one of the many interesting aspects of equality: tax shifting, which neither study had anything to say about, unfortunately (but perhaps understandably so in the Canadian context). Alan Reynolds from yesterday's WSJ (h/t Greg Mankiw):

As was well-documented years ago by economists Roger Gordon and Joel Slemrod, a great deal of the apparent increase in reported high incomes has been due to "tax shifting." That is, lower individual tax rates induced thousands of businesses to shift from filing under the corporate tax system to filing under the individual tax system, often as limited liability companies or Subchapter S corporations.

As far as I can tell, this doesn't seem like a big problem in Canada. Jack Mintz and Michael Smart (2001):

Canada integrates corporate and personal taxes by providing a dividend tax credit and excluding a portion of capital gains from taxation. At the small business level, the combined corporate and personal tax rate on equity income is roughly equal to the personal rate on employment and interest income, while for large companies combined tax rates on equity income exceed that of other income. When the small corporate tax rate has been changed in the past, governments have typically adjusted dividend and capital gains tax rates to maintain integration at the small-business level, in order to minimize incentives for shifting between corporate and personal tax bases.

The subject of "equality" often makes me want to rip my hair out, but there are surely thousands of useful, interesting ways to look at it, as StatsCan and WIDE have proven. What a thick and intriguing subject. Please, let's stop dissing it.

Posted by

true dough

at

6:34 AM

2

comments

![]()

Labels: equality

It's been a news-heavy week on the personal front, but I'm attempting to get back into some kind of routine, which would include catching up with my reading (a futile task) and blogging more regularly.

Here's just a small thought I've been pondering: How can we encourage individuals to commit to donating, including the donation of their money to charity, or the donation of their organs when they die? Maybe we shouldn't. (edit: At least not on an individual level).

First, consider organ donation.

The Edmonton Journal reports, “Health Canada has identified a shortage of organ donors in Canada, noting Canada has one of the lowest rates of organ donation in the industrialized world.”

Consider the ways we can encourage organ donation.

The government can commit to ad campaigns to attract the so-called "altruistic donor." It could also offer a tax deduction of, say, $5,000 or $10,000 off the estate of an organ donator.

The first option can be costly and ineffective. And, a tax deduction? Well, I happen to think that there shouldn't be an estate tax, so I'm not quite on par with this solution either.

Then there are financial incentives beyond tax deduction. Alex Tabarrok explains (2004):

In the minds of many, financial incentives for organ donation means rich people buying up kidneys being hawked on eBay by the desperately poor...Two distinctions are especially important. First, financial compensation for cadaveric donation and for living donation are different ideas and it is quite possible to have one without the other. Indeed, the primary cause of so-called organ tourism—rich people flying to poor countries like India to undergo a transplant from a poor, living donor—is the shortage of organs in the West. By allowing compensation for cadaveric donations we’ll increase the domestic supply and reduce the demand for people to fly to poorer countries for living donation. Financial compensation for cadaveric donation, in other words, is a substitute for both paid and unpaid living donation.

Second, organs are currently allocated according to a point system which is based on factors such as the quality of the match between donor and recipient, the length of time the potential recipient has been on the waiting list, the health of the potential recipient and so forth. It is not necessary to change these criteria in order to make use of financial compensation. Financial incentives can be used to increase the supply of organs without using finance to determine who will receive an organ.

The solution that has my attention is this: change the default. Andrew from “Statistical Modeling, Causal Inference, and Social Science” explains:

Over 99% of Austrians and only 12% of Gernans consent to donate their organs after death. Are Austrians so much nicer than Germans? Maybe so, but a clue is that Austria has a "presumed consent" rule (the default is to donate) and Germany has an "explicit consent" rule (the default is to not donate). Johnson and Goldstein find huge effects of the default in organ donations, and others have found such default effects elsewhere.

What does this have to do with financial charity donations? Andrew goes on:

Lots of research shows that people are likely to take the default option (see here and here for some thoughts on the topic). The clearest examples are pension plans and organ donations, both of which show lots of variation and also show people's decisions strongly tracking the default options.

....My hypothesis, then, is that the groups that give more to charity, and that give more blood, have defaults that more strongly favor this giving. Such defaults are generally implicit (excepting situations such as religions that require tithing), but to the extent that the U.S. has different "subcultures," they could be real. We actually might be able to learn more about this with our new GSS questions, where we ask people how many Democrats and Republicans they know (in addition to asking their own political preferences).

Does this explanation add anything, or am I just pushing things back from "why to people vary in how much they give" to "why is there variation in defaults"? I think something is gained, actually, partly because, to the extent the default story is true, one could perhaps increase giving by working on the defaults, rather than trying directly to make people nicer. Just as, for organ donation, it would probably be more effective to change the default rather than to try to convince people individually, based on current defaults.

I'm not quite sure how changing a default would work with regards to giving money to charity, or giving blood, without infringing on people's freedoms (I don't consider Austria's "presumed consent" rule to be such an infringment), but I like how Andrew is thinking and I'll be pondering his idea more.

Posted by

true dough

at

1:26 PM

4

comments

![]()

George, their opponent, was left with few options. He thus pulled out Stratagem XXVIII: “Persuade the Audience, Not The Opponent.” Brilliant counter attack. The public release of his phone conversation has surely left the blogosphere entirely persuaded (and amused).

A couple more days of hibernation and I'll be back (with less fluff).

Posted by

true dough

at

11:59 PM

0

comments

![]()

Posted by

true dough

at

11:06 PM

7

comments

![]()

With just a single month yet to be revealed, 2006 is shaping up to deliver the labour market’s best performance in three years with the expected addition of near 300,000 net new jobs. This stands in contrast to yesterday’s GDP report which shows that economic growth has slowed markedly over the middle quarters of 2006. However, an encouraging development for the final quarter is the pick up in hours worked. Over the first two months of Q4, hours worked have increased by 1.6%, reversing the 0.1% fall observed in Q3. The puzzle is to sort out whether this indicates more economic growth momentum though the fourth quarter of 2006 than suggested by the 0.3% decline in September’s real GDP or a flattening of labour productivity.

...the details are not as discouraging as the headline number would suggest. While some of the weakness can be traced to the second consecutive quarterly decline in residential investment, the main cause of the deceleration in real GDP growth was a combination of more moderate government spending and falling inventory investment – two of the more volatile components of real GDP. For example, part of the deceleration in government spending from 4.9% in the second quarter to 0.7% in the third was due in part to the one-off effect of the conclusion of the 2006 Census. Meanwhile, the fall in inventory investment likely reflects some unwinding from the significant accumulation in the previous quarter.

Posted by

true dough

at

9:29 AM

0

comments

![]()

Labels: labour

Posted by

true dough

at

9:26 AM

0

comments

![]()

Mary (Foley) Doyle

Mother, businesswoman. Born July 5, 1917 in Point Mall, Placentia Bay, Nfld. Died May 23 in St. John's, of heart failure, aged 88. Mary Foley was raised in Corner Brook, far from her parents' native Placentia Bay. Work had lured them west. Her mother was a determined redhead whose genius was to feed and clothe seven daughters and a son on a mill-worker's wage.

Mary graduated from St. Henry's, narrowly missed a university scholarship, and took “commercial.” She soon became a private secretary. One day, offered the rare opportunity to make a long-distance call, she phoned a Water Street merchant in St. John's, replying to an ad. Impressed, he hired her.

Three years later, Mary married Gerald Doyle. He was a widower, 25 years older than she, and living on an eight-acre estate. She stepped into a household with maids, a cook and a gardener — and five young motherless boys. Dinner parties, New York business trips, cruises and summers sailing around Newfoundland: She'd been swept into a world of glamour, travel, and love. When he died in 1956, he left a bewildered 39-year-old with three more small children in the mix. She was thrown immediately into a man's world as “chairman” of her husband's manufacturer's agency, in charge of 50 employees.

Mary Doyle never felt at home with St. John's “society.” She sought company, and found it in the Redemptorist priests: intelligent, urbane men who posed no threat to her widowhood. The mother of our childhood was stunning, decisive, and slightly scary. She wore a sealskin jacket, drove a Land Rover and had two German Shepherds. If a man hesitated when approaching her, she'd exclaim: A man who's afraid of dogs! She was fearless, bought and sold property without advice, and travelled without reservations, including a three-month European tour with kids. Later, she drove around Morocco in an Austin Mini. Fearless, yet. . . she once opened the front door, and ordered a passing teenager to come in and catch a mouse. At 53, her family raised, Mary walked into a classroom of 17-year-olds and began university. She took notes in shorthand, asked smart questions, and wrote A papers. At 57, she crossed the stage to collect a history degree. The photo records a proud and defiant woman.

Mary was anti-Confederate. Returning Canadian? she'd be asked at a border. I carry a Canadian passport. Canadian citizen? I was born in Point Mall. Eventually, a frustrated guard would let her pass. Her rage against Canada dates from 1939 when an immigration officer on a Halifax dock looked down at her seven-year-old Down Syndrome sister. He removed the child to a holding cell and next day handed her back: Entry Denied.

Mary was a fighter. Stacks of yellow paper document responses to injustice. In 1969 she fumed in a church pew on Fogo Island while a priest “harangued his own good people.” She wrote him about what he had “flung with vituperation” to “a captive audience who could not speak back.” She copied the bishop.

Her independence strengthened as she aged. At 77 she was tough enough to cope with the blow of losing a leg. For months her car sat idle in the driveway; she couldn't relinquish this symbol of mobility. In time, she installed a lift which she rode to a waiting wheelchair downstairs. She'd open the garage door remotely and take a cab to the bank. She and her dog carried on through the Newfoundland winters for five years. She moved in briefly with her youngest son then, with courage and insight, made the inevitable move to a home.

She was a rebel, and fires of defiance continued to burn even as her world grew smaller. She hung a bold sign on the door: No admittance after 11:00 p.m.John, Bill and Marjorie are Mary's children.

Posted by

true dough

at

6:42 AM

1 comments

![]()

Inflation target under review (Nov.27)

[UWO prof David Laidler] acknowledged it would be “risky” to change the rules without careful preparation of the public, but proposed a one per cent target, stressing that “a two per cent inflation rate is a far cry from anyone’s (or at least any retiree’s) idea of price-level stability.”

The Bank of Canada raises another, more complex, possibility: targeting a price level. This would mean that periods of above-target inflation — which under the current policy are written off while the bank seeks merely to return to the two per cent level — would have to be offset by periods of inflation below the target to produce stable long-term prices. The bank’s document acknowledges “the difficulty that might be associated with explaining price-level targeting to the general public.”

Officials intend to complete their research “well before 2011 so as to ensure sufficient time for open discussion of the results and their implications.”

Posted by

true dough

at

8:25 AM

1 comments

![]()

Labels: inflation targeting, monetary policy

I'm short on time, but I thought I would share a few links that I find interesting.

1. Are husbands like potatoes? Bryan Caplan provides some food for thought in his latest post over at EconLog. His reasoning isn't compatible with my own, but it's laugh-out-loud funny. According to him,

"Once women can become financially independent of a man, they will choose to do so." This is theoretically possible, but only if husbands, like potatoes, are inferior goods.

For Americans to meet the fruit, vegetable, and whole-grain recommendations, domestic crop acreage would need to increase by an estimated 7.4 million harvested acres, or 1.7 percent of total U.S. cropland in 2002. To meet the dairy guidelines, consumption of milk and milk products would have to increase by 66 percent; an increase of that magnitude would likely require an increase in the number of dairy cows as well as increased feed grains and, possibly, increased acreage devoted to dairy production.

Posted by

true dough

at

6:48 PM

0

comments

![]()

Productivity growth in sectors that intensively use information and communication technologies (ICT) appears to have accelerated faster in the US than in Europe since 1995. If this was partly due to the superior management/organization of US firms (rather than simply the US geographical or regulatory environment) we would expect to see a stronger association of productivity with IT for US multinationals located Europe than for other firms. We examine a large panel of UK establishments from all business sectors and provide evidence that US owned establishments have a significantly higher productivity of IT capital than either non-US multinationals or domestically owned establishments. Indeed, the differential impact of IT appears to fully account for almost all the difference in total factor productivity between US-owned and all other establishments. Further, this finding is particularly strong in the sectors that intensively use information technologies: the very same ones that account for the US-European productivity growth differential since the mid 1990s.

Addendum

How comparable is Canada to the UK when it comes to the productivity levels of IT? A recent article from The Financial Times sheds some light on this. The article suggests that the bursting of the dot com bubble may worsen things for both countries.

'Perfect storm' could stifle IT (Nov.22)

In the UK, a report by Lancaster University School of Management and the British Computer Society revealed that applications for computer science degree courses have dropped by half in the past five years. Software engineering applications have fallen by 60 per cent.

In Canada, things are not much better, according to the council organised by the government to monitor and promote the development of IT skills. Canada will need 89,000 new IT professionals in the next three to five years, warns the Information and Communications Technology Council, "yet enrolments in IT courses have dropped by 50-70 per cent because of the negative view of the IT sector," explains Paul Swinwood, president of the ICTC.

****

In Canada, the ICTC is also co-opting private sector organisations and community colleges as close to the client base as possible. "We're bringing together the engineers, the technicians and the technologists; my council, the Canadian Information Processing Society, and your local IT associations," says the ICTC's Mr Swinwood. "We can have a national programme but we need feet on the ground, in the community." Creating a link between high-level policy and direct action is crucial if IT education is to be effective in schools. The difficulties the sector faces in terms of generating appropriate skills are inseparable from its own success.For many teachers who advise young people, it moves too quickly and unpredictably for comfort. This is why the BCS's Mr Rodd has been horrified to see some teachers advising students against careers in IT, citing the uncertainty caused by the bursting of the dotcom bubble.

Posted by

true dough

at

1:06 PM

0

comments

![]()

Sorry for the lack of posts. I've been ill and unproductive, but I have less to complain about this evening.

Moving on...

Where does spontaneous order exist?

In the response mechanisms of white blood cells?

In the market place? And, by extension, in flight patterns? (h/t Cafe Hayek)

Be sure to read Russell Roberts' explanation of this last video.

These two (short) clips are really remarkable, especially when watched one after another. Well, I think so. It doesn't hurt that they're both set to hot music.

Posted by

true dough

at

4:39 PM

0

comments

![]()

Posted by

true dough

at

6:51 PM

2

comments

![]()

I'm slow to catch this, but Neil Reynolds had an interesting article in last Friday's Globe and Mail ($). Here's an excerpt.

Put our TV bands to better use: Sell them (Nov. 17):

Pssst. Here's a way to make Canadians a cool $6-billion, cut cellphone costs and simultaneously drive the wireless economy. Simply auction off the country's entire “TV band” — airwaves no longer needed for this redundant purpose.

When U.S. economist Thomas Hazlett looked at Canadian broadcast policy four years ago, he found an enormous waste of a scarce natural resource — the electromagnetic frequencies used by relatively few TV stations to transmit relatively few programs to relatively few people in relatively few cities. In allocating 67 TV channels, he said, Canada had “consumed valuable bandwidth while delivering very little service to the public.” Since federal regulators had given each channel six megahertz of frequency space, we were using up 402 MHz for TV signals alone, “a vast commitment of radio spectrum.” We're using freight trucks, in other words, to deliver carloads of TV programs.

With the same allocation of frequencies as Canada, the U.S. uses its band more efficiently by allowing 1,472 full-power TV stations (compared with 136 in Canada), 210 TV markets (compared with 43) and an average of 7.0 stations per market (compared with 3.1). This sparse use of the TV band meant that the typical Canadian market provided only three over-the-air channels. This didn't matter much to most Canadians — by 2002, 74 per cent of them had opted for cable TV, 7 per cent for Canadian satellite TV and 8 per cent for U.S. satellite TV.Here is Mr. Hazlett at the University of Montreal in June, 2002: “It is not possible to argue that 67 channels of scarce radio spectrum are optimally used to deliver [only a very few] video channels. The typical Canadian market uses just 4.5 per cent of its allocated bandwidth. The TV band is underemployed throughout the country. There are no offsetting efficiency arguments. This waste produces no social dividend.” Worse still, Canadians had already abandoned over-the-air TV. Only 10 per cent of Canadians still used TV antennas. Four years on, the number must now be even less.

Canada's profligate dispersal of bandwidth for over-the-air delivery of TV programs, long after Canadians had switched to cable and satellite TV, necessitated the country's parsimonious hoarding of bandwidth for New Economy wireless technologies. This is one reason why only 50 per cent of Canadians are using wireless devices — compared with 70 per cent of Americans and 100 per cent of Europeans. It's one reason why cellular phone service in Canada costs much more than it needs to cost. Industry Minister Maxime Bernier will auction off more spectrum next year, specifically for cellular and wireless tasks, which doesn't go nearly far enough.

Once chief economist for the U.S. Federal Communications Commission, Mr. Hazlett is now a professor of law and economics at George Mason University in Virginia. Recognized internationally as an authority on the economics of broadcasting, he serves as director of the university's Information Economy Project, which — in its mission statement — recommends that governments get out of the way and permit the “wireless century” to develop without needless bureaucracy and anachronistic regulation.

In his analysis of Canadian airwave use, Mr. Hazlett cited Italy as an example of a country in which government did get out of the way — though inadvertently. Deregulation, Italian style, occurred in the mid-seventies when courts permitted unlicensed entry into cable TV. The Italians spontaneously extended this liberty to all TV broadcasting. At the time, the country had 90 TV stations. Within 10 years, it had 1,300 — the highest TV station density in the world. (Canada and the U.S. have 0.05 TV stations per 10,000 people; Italy has 1.0). Italian TV stations get 20 times as much use from bandwidth as Canadian or American stations. Cable TV scarcely exists; it was never needed and serves less than 1 per cent of households.

Mr. Hazlett calculated “the enormous economic benefits” that would result were Canada to sell at auction the country's entire TV bandwidth. The country's remaining roof-top antennas would need to be replaced with satellite dishes at a cost of $600-million. But the TV band auction (based on Canada's sale of 40 MHz for $1.5-billion in 2001) would clear almost $6-billion.

Posted by

true dough

at

11:57 PM

1 comments

![]()

Posted by

true dough

at

10:57 AM

4

comments

![]()

Labels: self employment

To blog about anything except Milton Friedman's death seems unthinkable today. And yet I have nothing new to contribute. I'll just mark this sad news by pointing to Friedman's obit in The Financial Times (h/t happyjuggler0).

Addendum

Milton Friedman is my hero. After some thought, I do have something to say.

In the comment section of this post I was asked, “So what should the Canadian government be doing, as per your idol Friedman, that it is not already doing?”

Posted by

true dough

at

10:01 AM

2

comments

![]()

This might be one of the most exciting book reviews I've ever read.

From EH.net:

Published by EH.NET (November 2006)

Mark Wynne, Harvey Rosenblum and Robert Formaini, editors, _TheLegacy of Milton and Rose Friedman's Free to Choose: Economic Liberalism at the Turn of the Twenty-First Century_. Dallas: Federal Reserve Bank of Dallas, 2004. vii + 251 pp. $ (hardback), ISBN: Info:0-9763494-1-8Reviewed for EH.NET by Ranald Taylor and Robert Leeson, Department ofEconomics, Murdoch University.This book is a collection of papers presented at a conference held at the Federal Reserve Bank of Dallas in October 2003. It is a tribute to Milton and Rose Friedman's _Free to Choose_. The papers have a dominant theme: competitive markets can solve many of the problems associated with education, environmental degradation, taxation, cultural diversity, globalization, financial markets and monetary stability. The book is organized into six sessions, each devoted to particular issues which the Friedmans have raised in _Free to Choose_.Session one sets the tone of the book by revisiting Milton Friedman's organizing argument: that competition ensures economic freedom and that the appropriate role of a government in a free society is toensure that competitive markets function freely. Eric Hanushek andPaul Peterson examine the coexistence of what they believe to be the declining state of the public school system in the U.S. and risingreal spending per pupil. Hanushek argues for a competitive market-based funding system in the form of vouchers. Resistance to vouchers, he believes, derives from an old ideology. Hanushek arguesthat it is easier to defeat communism than to overcome the education establishment's resistance to meaningful reform of the public school system.Advocates of 'sustainable development' advocate changes in virtually every aspect of

consumption and production. In session two Terry Anderson and Laura Huggins argue that sustainable development theory is vague and "operationally vacuous" (p. 58).They challenge the two fundamental pillars of sustainable development: 'running out' of resources will leave future generation with less, and market processes are the causes of these depletions. According to Anderson, Huggins and Richard Stroup, the over consumption of natural resources is primarily linked to ill-defined property rights rather than the operation of the market system.Property rights, they argue, provide the structures that are necessary for development, innovation, conservation and the discovery of new resources. They maintain that countries with greater economic freedom and rule of law tend to have higher environmental standards than countries where the rule of law is weak.One of the themes of _Free to Choose_ was that government has grown far beyond the size necessary for the protection of liberty.In session three, William Niskanen constructs a model to estimate the optimal level of expenditure for government services relative to GDP. His estimate (10 percent of GDP) provides support for smaller governments. Liqun Liu, Andrew J. Rettenmaier and Thomas R. Savingargue that falling birth rates and rising life expectancy have made the current social security system unsustainable. Their analysis ofthe costs and benefits of a transition to a privately-funded system, suggests that during the transition period there would be a costinvolved in the form of lower consumption. However, in the longer term, they argue, the transition would make the country as a whole better off by enhancing the nation's capital stock.In session four, Tyler Cowen deals with the implications of _Free to Choose_ for culture, diversity and aesthetics. Globalization and free trade benefit both cultural diversity and the creative arts, Cowan argues: periods of greater freedom in international trade tend to beperiods of greater cultural diversity and creativity.Peter J. Boettke examines the impact of _Free to Choose_ on global movement toward free markets during the period from 1979 to 2003. During this period, communism collapsed in the Second World, theThird World began to reject development planning, and many First World countries reformed their welfare states. Boettke notes thatmuch post-communist privatization was inspired by Friedman's writings.Gregory Chow uses the central themes of _Free to Choose_ to examinepost-1978 reforms in China, sensing progress in all areas. With reference to education, Chow claims that there is probably a greater degree of freedom of choice in education in China than the U.S. (heargues that about 40 percent of all spending on education in China comes from private sources compared to an average of 12 percent inthe OECD countries).Session five has a topical immediacy given that the Grameen Bank andits founder, Muhammad Yunus, were jointly awarded the 2006 Nobel Peace Prize. Luigi Zingales argues that access to finance is crucial to promote competition and economic freedom. Zingales describes thefate of two Bangladeshi women (one with access to finance, the other without). The second found it extremely difficult to develop her stool making business; the first obtained a small loan from the Grameen Bank to acquire a Nokia cellular phone. The phone made a huge difference in her life and the lives of her fellow villagers by bringing information at low cost to farmers and tradesman. The phone reduced business costs facilitating profits about twice the average national monthly income.Zingales argues that although financing is a risky and complexactivity, riddled with adverse selection and moral hazard, it is government intervention that is the main obstacle: "In spite of theenormous challenges intrinsic to the financing activity, human ingenuity, when allowed to work freely, is able to devise many mechanisms to enlarge access to finance. It cannot, however, overcome the power of the government, when this is determined to block finance. Unfortunately, governments are too often captured by rich incumbents, who stand to gain very little and risk a lot from the development of finance" (p. 188).Allan H. Meltzer itemizes twenty-five specific policy proposals initiated by Milton Friedman (some of which have been adopted and many of which have not) to minimize government intervention. He looks at some of the successes (ending the military draft, floating the dollar, the abolition of interest rate ceiling on bank deposits) and some partial successes (lowering tariff barriers, deregulation various industries in the U.S., the introduction of a school voucher system in certain U.S. states).Ben S. Bernanke examines eleven of Friedman's key monetarist propositions. According to Bernanke, Friedman's counter-revolution isstill very much alive: "one can check to see if an economy has a stable monetary background only by looking at

macroeconomic indicators such as nominal GDP growth and inflation. On this criterion it appears that modern central bankers have taken Milton Friedman's advice to heart" (p. 213).The last session traces the relationship between economic freedom and growth performance. The Friedmans believe that economically free countries would grow more rapidly and achieve higher income levelsthan less free countries. To test their hypothesis, they saw the need to develop a scientific instrument that could be used to quantify the degree of economic freedom across a large number of countries. James Gwartney pioneered the construction of indexes to proxy economic freedom. Based on the Economic Freedom of the World (EFW) index (taking into account of private ownership, voluntary exchange,personal choice, and free entry into markets), Gwartney and Robert Lawson report that a one-unit increase in the EFW index enhancedgrowth by 0.71 percentage points over the period 1980-2000: "Friedman was right" (p. 232).

As a conclusion to the book, Raghuram G. Rajan offers somereflections on whether the free market tide may retreat (in LatinAmerica, for example). Rajan argues that the growing backlash againstpro-market reforms is driven by elites who tend to undermine equalityof opportunities by opposing widespread access to markets.This is a fascinating book -- a must read for Friedman fans. One of Friedman's strengths was (and is) his intense curiosity about the strengths and weaknesses of the arguments and unexamined assumptions of his opponents. Some of those who have documented the progress of his ideas have been struck by the initial lack of reciprocity in this respect (in the early days his ideas were often dismissed as Chicagoeccentricity). Friedman was a dominant figure among the first generation of post-war libertarians: this salute by some of thesecond generation provides an insight into the dynamics of the ideas that he developed and propagated.Ranald Taylor is the author of "Can Labour-Savings, Capital-IntensiveProduction Techniques Reduce Unemployment Rates in DevelopingCountries?" _Australian Journal of Labour Economics_ (2004). He is currently working on a project tracing the evolution of technological progress since Adam Smith.Robert Leeson is the co-author (with W.J. Darity and W. Young) of_Economics, Economists and Expectations: From Microfoundations to Macroapplications_ (Routledge: 2004) and is currently editing Milton Friedman's _Collected Writings_.

Posted by

true dough

at

4:59 PM

2

comments

![]()

Labels: wish list / reading list

Extra, extra! Firms realize that government spending is not a solution to their economic woes! Today's Globe and Mail highlights the response from the manufacturing sector as it suffers a slowdown like no other sector of late:

Canada's manufacturers are turning up the heat on Ottawa to help them out of their deep economic troubles, but the wish list is surprisingly timid given the extent of their woes.

That's probably because there's little that the federal government can do about the underlying cause of most of their troubles, economists say.

“Why aren't they asking for more? It may be the realization that a lot of their problems are way beyond the control of the Canadian government,” BMO Nesbitt Burns economist Doug Porter said.

The manufacturers will launch their lobbying effort today, publicizing a letter they recently sent to Prime Minister Stephen Harper that asks for lower corporate taxes, less red tape and better tax credits for research and skills training.

The hope is to win some commitment on manufacturing issues in next week's fiscal update, followed by concrete measures in next year's budget.

While lower corporate tax rates could be expensive for Ottawa, the manufacturers merely request the government keep its promise to reduce the corporate tax rate to 18.5 per cent by 2011, and then go a step further to 17 per cent by 2012.

As for tax credits, they want Ottawa to make its research and development regime more relevant, but not necessarily enrich it. And they want a new tax credit for training.

The most immediate and expensive request would have Ottawa allow capital investments to be written off over two years (instead of the eight to 10 years it now takes) — a proposal that would immediately improve the cash flow of companies investing in new technology, but one that would cost Ottawa about $1.5-billion in the first year.

The manufacturers have made no mention of handouts or lump sums of money, despite the painful restructuring the sector is enduring. So far, 83,000 jobs have disappeared in the sector this year, and about 200,000 since the end of 2002. Manufacturing output is flat compared with a year ago, and profit growth has slowed to a crawl. In Ontario, profits are falling.

“These are not issues that bailouts will fix,” said Jayson Myers, chief economist of the Canadian Manufacturers & Exporters.

Rather, the proposals would put Canadian manufacturers on a level playing field with other countries for taxes and investment incentives, he said.

Manufacturing in most developed countries has been under intense pressure for the past few years because of the rise of cheaper competition in China, but Canada faces some unique issues, Mr. Porter said. In the short term, Canada is particularly exposed to the slowdown in the U.S. economy, he said. In the medium term, the quick appreciation of the Canadian dollar is a serious issue other countries' manufacturers don't have, he added.

But manufacturers should probably not hold their breath for immediate action by the federal government. Next week, Finance Minister Jim Flaherty will unveil a Conservative economic road map aimed at making Canada a more powerful player in global markets. The economic agenda will not contain tax cuts or fiscal measures, but will lay out a direction for next year's budget and beyond, he said.

“This is a document that we hope will be a plan for the next 10 years or so,” Mr. Flaherty said Sunday.

“We are going to talk about, as part of the plan, about our direction in tax policy for our country, our direction in skills training and postsecondary education.”

The long-term economic plan will make the case for measures to boost Canada's productivity, although the Conservatives are expected to eschew the term in favour of Main Street friendly phrases such as “increasing opportunities” for Canadians. The agenda will argue for more investment in education, research and infrastructure, such as highways and border crossings, as well as a big role for the private sector in financing the latter.

In some respects, the Harper government is now moving closer to its Liberal predecessors in its economic focus. Sources have said the Tories are drawing on the 143-page “Plan for Growth and Prosperity” paper that former Liberal finance minister Ralph Goodale's department released just two weeks before his government was defeated.

Posted by

true dough

at

10:34 AM

5

comments

![]()

Labels: corporate tax, manufacturing

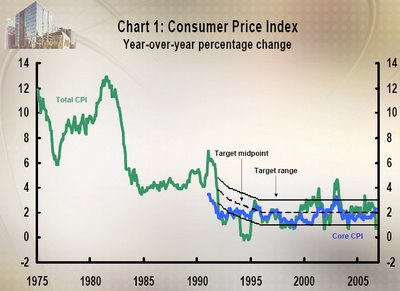

With the expiry of the inflation-control agreement held between the Bank of Canada and the Government of Canada arising this December, people are talking.

Some background from the BoC:

In February 1991, the Government and the Bank introduced targets aimed at reducing the rate of inflation. The objective was to achieve a 3 per cent inflation rate by the end of 1992 (the lowest inflation rate in almost two decades) and to gradually reduce the rate of inflation to 2 per cent by the end of 1995. The targets were extended twice—first from the end of 1995 to the end of 1998 and then from the end of 1998 to the end of 2001. Both extensions involved maintaining a target range of 1 to 3 per cent with a midpoint of 2 per cent.

Graph Source: Government of Canada

Graph Source: Government of Canada

Pierre Fortin, an advocate of the theory of downward nominal-wage rigidity, says it should be raised to three per cent (Fortin, P. 2001. "Inflation Targeting: The Three Percent Solution." Policy Matters 2: no.l, Institute for Research on Public Policy). This is unlikely to happen though. The BoC maintains that “the argument for the effects of downward nominal-wage rigidity is not a persuasive one in deciding on an appropriate inflation target.”

David Laidler of UWO says the rate should be lowered to one per cent.

The Zero Floor on Nominal Interest Rates

A number of authors have argued that the zero floor on nominal interest rates prevents real (that is, inflation-adjusted) interest rates from falling far enough when inflation is below its target, thus leading to a prolonged period in which the economy is weak and inflation remains below its target. After reviewing the evidence, including importantly Black, Coletti, and Monier (1998), and the papers in Fuhrer and Sniderman (2000), Bank economists Amirault and O'Reilly (2001) conclude that most researchers would estimate the probability of hitting the zero floor as negligible for an inflation target of 2 per cent. Moreover, although this probability rises at an increasing rate as inflation falls, their evaluation of the empirical literature is that there would be only a slight increase in the probability as one moved down to a 1 per cent inflation target. This latter conclusion is less widely held. Some authors are more cautious regarding the proposition that the probability increases only slightly, in contrast to Parkin (2001). As well, Parkin notes that the work of Reifschneider and Williams (2000) shows that explicitly taking into account (in various ways) the zero floor in the central bank's reaction function for setting interest rates significantly lowers the cost of hitting the zero bound in the unlikely event that it is hit.

Potential Risk of a Costly Deflation

Mishkin (1997, 2001) has emphasized the importance of avoiding deflations because of their cost. It is important to distinguish at the outset, however, between an unexpected price decline (of, say, one year in duration) and a persistent deflation. It is also necessary to note that there are costs whenever consumers, firms, and financial institutions are adversely surprised. An unexpected price decline of, say, 2 per cent with an inflation target of zero is no more costly than a temporary drop in the inflation rate to zero for a year with an inflation target and expected rate of inflation of 2 per cent. On the other hand, a deflation with some persistence will be more costly than a reduction in inflation of the same size if it causes problems to arise either from hitting the zero floor on nominal interest rates or from downward nominal-wage rigidity. For example, persistent deflation at 2 per cent per year when the inflation target is zero would be more costly than inflation persisting at zero when the inflation target is 2 per cent only to the extent that its persistence becomes more prolonged because of those two problems. But it is important to note that central bank targeting of a specific inflation rate provides a high level of protection against persistent deflation.

We conclude from this analysis that the serious problems come from persistent deflation, that they stem from the first two factors discussed in this document, and that they are unlikely to arise under explicit inflation targeting.

Posted by

true dough

at

10:38 AM

0

comments

![]()

Labels: BoC, inflation targeting, monetary policy

Kalle Lasn, a Vancouverite and the founder of Adbusters magazine, believes that consumers are irrational precisely because they consume too much. He claims that over-consumption has consequences on the environment, the political atmosphere, and so on.

Kalle Lasn, a Vancouverite and the founder of Adbusters magazine, believes that consumers are irrational precisely because they consume too much. He claims that over-consumption has consequences on the environment, the political atmosphere, and so on. A great deal of individual behavior appears to be perfectly rational; Most of that which does not appear so rational has small consequences for the individual decision maker (with the "irrationality" tending to disappear over time); There are always some people who persist in making apparently irrational, and costly, choices.

But Kalle is an extremist, an anarchist even, and his ideas go much further (case in point: Buy Nothing Day/Season). Does he believe what he promulgates or does he overshoot his message to encourage individual thought?

But Kalle is an extremist, an anarchist even, and his ideas go much further (case in point: Buy Nothing Day/Season). Does he believe what he promulgates or does he overshoot his message to encourage individual thought?

Posted by

true dough

at

9:19 AM

0

comments

![]()

Labels: consumerism, rationality

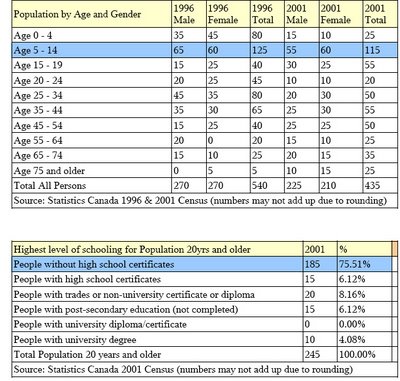

There are very few things that outrage me, but watching kids grow up on squalid native reserves does the trick.

I've highlighted some numbers from the Statistics Canada 2001 Consensus for the Cold Lake Indian Reserve #149. Cold Lake is not unique, as a quick browse around this link to StatsCanada shows.

I've highlighted some numbers from the Statistics Canada 2001 Consensus for the Cold Lake Indian Reserve #149. Cold Lake is not unique, as a quick browse around this link to StatsCanada shows.

Posted by

true dough

at

7:59 AM

0

comments

![]()

Labels: native affairs

1.

'The latest jobless rates and what's behind them.'

CBC has a nifty interactive tool offering a very general idea of what's going on with employment in each province.

2.

Q: What do you get when you mix obnoxious attitude, grammatical errors, anonymous hacks and a respectable news magazine?

A: The new blog from The Economist magazine. Hip hip!

Posted by

true dough

at

8:50 AM

5

comments

![]()

Addendum II: Et voila! Not only is this graph clearer, but it contains more data. (Thank you Ms. D.L.! I knew blogging would pay off!)

Addendum II: Et voila! Not only is this graph clearer, but it contains more data. (Thank you Ms. D.L.! I knew blogging would pay off!)

Posted by

true dough

at

11:03 PM

0

comments

![]()

Labels: agriculture, labour, self employment

Grrrr. I've switched to beta blogger and it's not being kind to me, hence the reason this post disappeared. One more time...

I'm stumped by this contradiction: October's net gain in employment was a whopping 51,000 (more than double expectations) despite poor GDP performance. What's up?

What analysts are saying isn't making sense. Here's CIBC's Avery Shefield:

Are we really seeing a case of job hoarding? Maybe in select businesses (construction), but elsewhere evidence suggests otherwise.Typically, employment growth lags the initial turn to slower economic activity, as businesses hoard labour for a while before bearing the costs of layoffs. That could be behind the stubbornly healthy trend in hiring of late, one that contrasts with poor GDP growth in Q2 and Q3.

One of the main reasons for this aggregate strength is that relative to previous periods of economic slack, the balance sheets of Canadian firms are extremely healthy and the level of operating profits remains near the record high set in the fourth quarter of 2005. As a result, the vast majority of firms are in a much better position to weather this economic downturn without resorting to layoffs or job cuts.

In sum, surely a small drop in labour can be expected (eg. in the construction industry), but not to the extent predicted in the next quarter or two. The problem is, if I'm right, and businesses aren't hoarding labour, why else would job growth be so out of whack with GDP growth? A new job growth equilibrium?

Anyone who regularly reads this blog knows that I break promises. I say I'll return to a subject and then I leave it for dead. I'll be coming back to this one when November's employment figures come out though. I promise.

Posted by

true dough

at

1:28 PM

1 comments

![]()

Labels: labour