“Taxed into a target: A manufacturer says his province has set him up for foreign takeover”

I haven't come across a link to this story from yesterday's National Post, but I thought it was interesting so I'll post the whole (long) thing.

It wasn't so long ago, Robert Hattin recalls, that Hamilton wasn't such a bad place to run his manufacturing business, Edson Packaging Machinery Ltd. Among the best eatures was a competitive corporate tax regime. To borrow from the province's unofficial anthem, Edson believed Ontario was a place to stand and a place to grow.

That was five years ago. Today, Mr. Hattin says, he is not quite so bullish. "It used to be that there were only three other U.S. states with more favourable [corporate] tax rates than Ontario. Ontario is now down in the middle of the pack -- that is how quickly the Americans have changed their tax regimes," says a frustrated Mr. Hattin. "And as an investor you are going to have to decide whether you are going to invest on this side of the border, on the other side, or in another country."

Experts say the higher tax rate -- which incorporates all federal, provincial and municipal levies -- makes it all the more difficult for Canadian firms to build themselves into industry leaders and compete on a global scale. It also dissuades investors from setting up shop in the country, knowing there are other countries or

jurisdictions with more favourable tax treatment.

Without changes at the behest of all levels of government, Mr. Hattin as well as many economists warn, Canadians firms could be ripe for the picking. "We are at risk of becoming an economy of sales agents representing product from somewhere else," Mr. Hattin says.

Is Mr. Hattin exaggerating? Not according to the experts, and not according to the statistics.

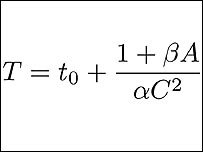

The C.D. Howe Institute, a leading think-tank, has calculated Ontario will have the highest effective federal-provincial corporate tax rates for non-resource companies. At 42.2%, Ontario's is also the highest among 36 industrialized economies, except China. The effective tax rate is a measure of tax on business investment and takes into account such things as corporate income taxes, depreciation allowances, inventory cost deductions and investment tax credits.

In addition, the combined federal-provincial corporate income tax rate in Canada stands at about 33% -- five points higher than the average of industrialized countries that are members of the Organization for Economic Co-operation and Development. Moreover, countries such as Norway and Germany have plans to aggressively cut corporate rates further.

Logic dictates that the higher the tax rate, the less available cash companies have to invest, either in capital improvements, to make their operations more efficient and productive, or in acquisitions or employees.

"I think we have a tax system that takes away the capability of investors to be able to expand from a Canadian investment base -- and that leaves us sitting ducks in many sectors for takeovers from international investors who have the big bucks," says Jayson Myers, chief economist for the Canadian Manufacturers and Exporters.

Not everyone shares Mr. Myers' view.

Don Drummond, chief economist at Toronto-Dominion Bank, says the tax system has been only a minor factor behind a recent binge of foreign acquisitions..

"Do I think it is the number one reason? No," he says, noting that there is more direct investment going out of Canada than there is coming into the country.

He adds that Canadian corporate profits, measured as a share of national income, are at their highest peak yet, which undermines arguments for tax relief. "It is not as if

corporations are starved for funds."

Nevertheless, there is a consensus among economists such as Mr. Drummond, business people and federal legislators that fine tuning is required to maintain a Canadian corporate presence.

In its first budget, tabled last May, the federal Conservative government acknowledged there was a corporate tax problem -- something the previous Liberal regime was reluctant to utter.

"Even with the tax reductions proposed in this budget in place, Canada will remain under pressure to improve the competitiveness of its tax system," the government said. "International trends are to lower business tax rates. Many other countries -- including small countries with open economies and generous social benefit systems like Finland, Sweden and the Netherlands -- have more competitive corporate tax systems than Canada."

That budget, which passed last spring, will see the Conservative government reduce the general corporate rate to 19% from 21% by 2010, and the corporate surtax eliminated as of Jan. 1, 2008. It also called for the tax on capital to be killed, retroactive to last Jan. 1. Combined, it is $9-billion of annualized relief.

Besides the standard tax on corporate income, firms face other levies. Perhaps the most frustrating for business is the tax on capital, which the Conservative government has eliminated, but which is still levied in other provinces, most notably Ontario. This is tax applied on investments made by business, such as productivity-enhancing machinery, and on cash raised to acquire assets.

"In Canada, if you are a national company and you wanted to raise $1-billion to buy something in the United States, you get hit with $10-million in provincial capital taxes," Mr. Drummond says. "Even though $10-million out of $1-billion doesn't sound like a lot, it is a $10-million bill your foreign competitor does not face, and it changes [potential] deals on the margins."

Besides the federal government, Saskatchewan and New Brunswick have moved to eliminate their capital taxes, by 2008 and 2010 respectively. Ontario has pledged to do the same, but not until 2010 at the earliest if fiscal conditions permit. Otherwise, 2012 is the target date, and observers believe that is not quick enough.

Jack Mintz, former head of C.D. Howe and one of the country's top tax experts, says the country's tax regime, as it stands, penalizes growth and that differs sharply from the United States. As a result, Canada has plenty of small businesses and a good collection of large corporations, but lacks the medium-sized enterprises that are candidates for growth.

"We have tax incentives for small business," he says, "but as soon as you go beyond a certain profit level you lose them. We provide signals that say you are better off staying small. You don't get a lot of growth from small businesses."

Despite the concern and evidence, experts worry governments will continue to put corporate tax issues on the backburner. They point to what transpired last year, when the Liberal government -- fearing the demise of its minority administration -- sacrificed $4.6-billion in business tax relief to secure the support of the left-leaning NDP.

"We have a corporate tax structure that may have made sense in one era when we were reaping the benefits of a resource-based economy," says Mr. Myers of the exporters group. "It is based on the assumption that once businesses set up shop, they are not going to move and they'll make money, and that money can be taxed away.

"That's an outdated model of taxation. It would be hard to say the model suited the 20th century, let alone the 21st."