Yesterday's state-owned oil, today's debt

Few of the princes, politicians and strongmen who wield ultimate authority over these firms can resist the urge to meddle. At best, this leads to the sort of inefficiencies found at most state-owned firms: overstaffing and underinvestment. At worst, the business of pumping and selling oil is entirely subsumed by politics. In ither case, national oil companies produce less oil, more expensively, than they should.

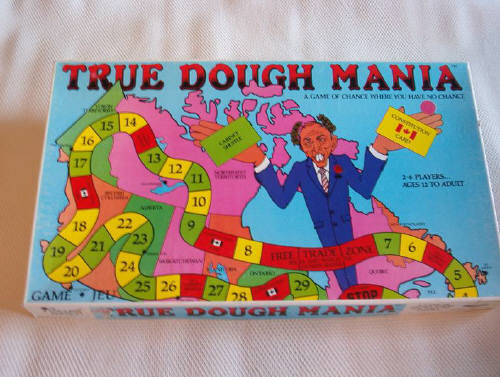

The Economist may as well have been criticizing Canada for its fiasco with Petro-Canada, an experiment of the '70's in which we still have a debt to show for. Instead, the article gave Venezuela centre stage and spared Canada. We didn't deserve that. Not when more than 20 per cent of Canada's national debt is attributable to what we still owe for Petro-Canada, as reported by Neil Reynolds (“Petrocan debt has taxpayer over a barrel,” The Globe and Mail: Aug. 25 -- $ subscription req'd).

Here are some excerpts from Reynold's piece:

How much did Canadians pay for Petro-Canada? David L. Yager, a Calgary oil field service industry executive, asks it in a different way. How much are we now paying? The federal government sold its last Petrocan shares a couple of years ago, and you may have thought that we had finished with this sorry 1970s experiment in state-owned oil companies. Not so.

We sold off the assets for less than we paid, then kept all the debt. By Mr. Yager's calculations, a detailed spreadsheet that covers 25 years, we now owe $80-billion for Petrocan — more than 20 per cent of the national debt. At 5-per-cent interest, we're paying $4-billion a year for an enterprise we don't own. This is slightly less than we pay for national defence; slightly more than we spend for foreign aid.

***

Liberal prime minister Pierre Trudeau established Petrocan in 1975. In its first direct acquisition, the company paid $342.4-million for Atlantic Richfield (1976). It paid $1.4-billion for Pacific Petroleum (1979) and $1.4-billion for Petrofina (1981). It paid $347.6-million for Gulf's upstream assets (1982) and $1.8-billion for Gulf's downstream assets (1985). Along the way, it accumulated 10,000 people on the payroll, twice as many as it needed. Although oil prices collapsed in the mid-eighties, Petrocan kept spending. As Mr. Yager observed: “With its move into refining and retailing, Petro-Canada's original mission (security of supply) was forgotten. The new marketing slogan was ‘It's Ours.'

***

We'll never know the entire public investment but it had certainly exceeded $6-billion when Conservative prime minister Brian Mulroney put the company on a path to privatization.For his calculations, Mr. Yager made two assumptions — that the funds for Petrocan's acquisitions were borrowed (and remained borrowed) and that the debt compounded in the normal way. He used the current value of the money in the years in which it was borrowed, then expressed the accumulated debt in 2005 dollars. He used the Bank of Canada rate (on each successive Jan. 1) plus one percentage point to determine interest charges. On the gargantuan balance, he says: “We'll continue to pay interest on this debt all of our lives. Rest assured that it is ours.”

No comments:

Post a Comment