Taxes in Turkey

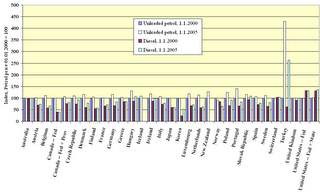

I've been looking at the different taxes that exist in OECD member countries. Turkey has taken me by surprise. Perhaps I've been living in the dark, but check out this comparison between tax rates for unleaded petrol and diesel (click on any graph to be sent to relevant OECD page, or find the main page here):

Check out Turkey. The graph, taken from the OECD website, is accompanied by this blurb:

...developments in the nominal tax rates for unleaded petrol and diesel in each country, expressed in national currency, between 1.1.2000 and 1.1.2005 are illustrated. Each bar represents an index, where the tax rate for unleaded petrol as of 1.1.2000 is set equal to 100. One can notice the very strong increases that have taken place in the nominal tax rates for both unleaded petrol and diesel in Turkey. No correction is, however, made for inflation over this period.

It's helpful to know that Turkey's population was 68.6 million in 2002; its GDP was $183.1 US billion; and its consumer price inflation was 45% (Data from The Economist Intelligence Unit).

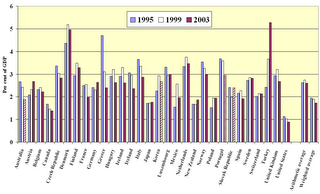

Below are two other interesting graphs.

This graph shows revenues from environmentally related taxes in per cent of GDP:

And finally: Revenues from environmentally related taxes per capita. Again, notice Turkey.

The Economist Intelligence Unit provides some good data comparisons (GDP, population, inflation) among a few countries here. I'd like to explore the explanation behind these graphs when I have more time. The OECD warns that these graphs should be interpreted cautiously. More info on them can be found here.

No comments:

Post a Comment